-

Half (46%) of employees aged 21-30 are concerned about the impact of an ageing workforce on their career paths

-

Health benefits and flexible working needed to support older workers

-

Yet a third (31%) of all employees do not receive any workplace benefits – up from 26% in 2014

There is a growing trend of employees staying in the workplace for longer, with Canada Life’s survey revealing that almost two thirds (61%) of employees expect to work beyond the age of 65.

As well as preventing job movement – and potentially blocking younger workers from progressing in their careers – employees also believe that an older workforce will have more health issues, therefore changing the working dynamic (20%). Nearly a quarter (23%) of staff agree that older workers will have to retrain or learn new skills so they can stay in work. Almost a fifth of employees (18%) believe employers may choose to give staff incentives to retire in an attempt to avoid these problems.

Rise in number of people who receive no workplace benefits

In order to support an older workforce, employers will need to make adequate provisions: more than two in five (43%) employees believe flexible working will be most important to help older staff to succeed, while other key solutions include part-time opportunities (23%) and new skills training (21%).

In terms of employee benefits, one in five respondents (20%) believe that critical illness cover is the most useful product for those working past the age of 65, up from 18% in 2014. This is followed by income protection (19%, up from 16% in 2014) and then life insurance (11%).

However, almost a third (31%) of current employees do not receive any workplace benefits at all, an increase of 5% from the 26% who reported this in 2014. This suggests that improving economic conditions are having little effect on employee benefit packages and although auto-enrolment of pensions has brought workplace benefits into the spotlight, this has done little to advantage employees.

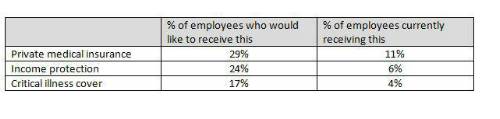

Almost a quarter of employees (24%) would like to receive insurance that covers you in case you are ill or injured and unable to work: however, just 6% receive this. Similarly, 17% would like a policy that pays out a lump sum should you become critically ill but only 4% currently benefit from this. Private medical insurance topped the employee benefit wish list, with 29% wanting to receive this from their employer: however, just over one in ten (11%) currently have this.

Paul Avis, Marketing Director of Canada Life Group, comments:

“Older workers have much to offer an organisation, including years of experience and often an in-depth knowledge of how their company works. However, younger employees are clearly concerned that an older workforce will make the jobs market more static, preventing them from progressing in their careers.

“Employers can dissuade these fears by making provisions that reassure staff of all ages they care about their wellbeing, job satisfaction and progression. However, older employees will often need specific support, particularly as health issues tend to be more common among those who work beyond the age of 65. It is therefore concerning that such a large number of employees fail to receive any benefits in support of this, with almost a third receiving no benefits at all.

“Workplace benefits are an integral part of staff recruitment and retention as well as offering invaluable support to employees and their family members should an accident or illness occur. Auto-enrolment (AE) has created the perfect opportunity for organisations to review their whole benefits offering, and many protection products can be brought in at a relatively low cost. As smaller companies reach their AE staging date, all employers should be considering whether their benefits package supports a happy and productive workforce.”

|