By ditching the “gilts-plus” methodology adopted at the previous valuation, the actuarial deficit across BAE’s nine DB schemes has remained broadly unchanged from the 2014 valuation.

BAE now favours an “asset-led” methodology – approved by the Pensions Regulator – that reflects a prudent expected return on the assets the schemes actually hold. The result is only a small increase to BAE’s annual deficit contributions.

Explaining the change, a spokesperson for BAE said: “More than 50 per cent of our assets are invested in equities and property… we’ve come to the conclusion that linking to gilts doesn’t make much sense for us.”

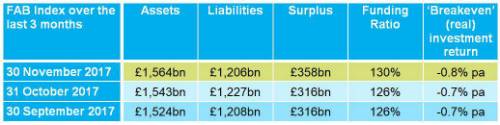

The FAB Index – which provides the best estimate position of the UK’s 6,000 DB pension schemes calculated using the best estimate expected return on the assets held by those schemes – reached a record high in November with a month-end surplus of £358bn, and a 130% funding ratio.

The PPF 7800 Index also reported a 3-year low in November, with the aggregate PPF deficit across the UK schemes falling to £87.6bn at the end of November 2017, and a 94.7% funding ratio. This was partly as a result of moving to the Pension Regulator’s Purple Book 2017 dataset, which has improved the funding position of the 6,000 schemes. This is despite the Purple Book 2017 revealing that the proportion of assets held in aggregate as equites has fallen from 30.3% to 29.0%, and aggregate bond holdings have increased from 51.3% to 55.7%.

First Actuarial Partner Rob Hammond said: “It is good to see BAE adopting a common-sense approach to funding. This has allowed it to keep deficit contributions down to sensible levels and keep its DB schemes open to future accrual. Many other DB schemes have been forced to close to future accrual due to overly prudent valuation assumptions, and a week doesn’t seem to go by without hearing about another one going the same way.

“Hopefully, BAE’s approach will make other trustees and sponsors question their advisers, rather than blindly following a ‘gilts-plus’ methodology, only suitable to schemes in specific circumstances and with certain objectives.

“November saw much to be positive about in the DB pension world. A record FAB Index surplus and a 3-year low for the deficit in the PPF 7800 Index, suggests the UK’s 6,000 DB schemes are in a healthy position.”

The technical bit…

Over the month to 30 November 2017, the FAB Index improved, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £316bn to £358bn.

The deficit on the PPF 7800 Index also improved over November from £149.8bn to £87.6bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best estimate basis – the so called ‘breakeven’ (real) investment return – has fallen to minus 0.8% pa. That means the schemes need an overall actual (nominal) return of 2.8% pa for the assets to meet the liabilities.

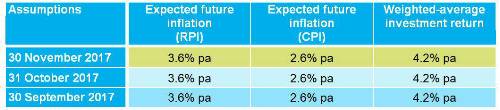

The assumptions underlying the FAB Index are shown below:

|