By Stuart Faloon is the FFA Head of Settlement Consulting at Buck

This has had a compounding impact on the premium rates insurers charge for BPA policies.

The strong demand from trustees and sponsors of pension schemes to purchase BPAs during 2019 gave insurers a strong negotiating hand to choose which counterparties they would engage with. Consequently, insurers’ focus has gravitated towards larger transactions (where the prize was worth the risk of being unsuccessful). Whilst competition amongst insurers enabled larger schemes to maintain a comparatively strong negotiating position, insurers’ strong pipeline of business opportunities has caused their appetite to price aggressively to be muted.

For smaller schemes, with negotiating levers being much more limited, the only route to market was often to partner with a single provider. Under this approach, the insurer is set a price target that is required to meet for the transaction to proceed. Even where such an approach is followed, the expectations of managers and trustees of schemes looking to carry out very small transactions have had to be carefully managed: the smaller the transaction, the poorer the terms offered.

In January and February, it looked like 2020 would follow a similar narrative to 2019. Insurers continued to anticipate a strong pipeline of activity, albeit the average size of transactions was expected to fall slightly as they expected fewer £1bn+ in transactions to complete in 2020 compared to 2019.

The challenges following COVID-19

Everything changed in March as it became clear that COVID-19 had become a global pandemic and that, in addition to human suffering and deaths, there was going to be a severe downturn in the global economy. Companies across the globe are scaling back their operations and seeking, where possible, to preserve cash.

Consequently, discretionary expenditure is being deferred or cancelled. This extends to pension de-risking projects, with insurers now anticipating a curtailment to their 2020 pipeline as companies (a) are less inclined to pay cash top-ups to cover funding shortfalls against the cost of buying out a pension scheme’s liabilities, (b) consider the negative accounting impact of a BPA transaction on the company’s balance sheet as unattractive, and (c) are withholding budgetary approval in respect of the costs of transacting a BPA.

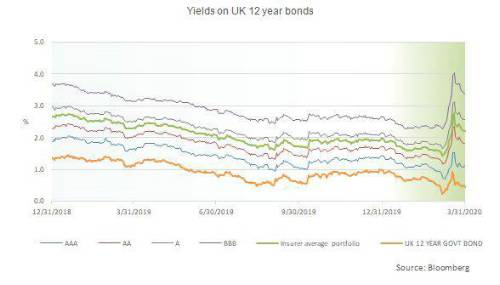

Whilst increased economic uncertainty has caused the yield on “risk free” bonds to fall, the yield on corporate bonds and other forms of alternative credit assets has increased. Insurance companies typically invest in a portfolio of credit assets with the average credit rating of their portfolios sitting between “AA” and “A” rated credit.

As the yields on the assets insurers hold to meet their BPA liabilities have risen, so the best estimate of the cost of the BPA will have fallen. However, the economic risk to which an insurer is exposed is likely to have increased. The amount of additional capital that the insurer is required to hold to mitigate such risk, therefore, may also have increased.

With every threat there is opportunity!

The threat is the extent to which we will see an increase in defaults amongst corporate bond issuers. Those insurers that consider that the market is correctly reflecting an increase in default risk have taken the view that the higher yields are to reflect the additional default risk and, therefore, that there is no justification for changing the risk-adjusted rates of return they use in their pricing bases. Consequently, they are continuing to quote premium rates at levels equivalent to those available at the start of the year.

By contrast, some insurers are taking the view that the increase in corporate bond yields, in part, reflects market overreaction and, therefore, that the risk-adjusted rate of return on assets held to back BPAs has fallen. These insurers have reduced their premium rates.

For well financed schemes, whose portfolio of matching assets is predominantly invested in government bonds and who are ready to proceed with a transaction, the current market dislocation may present an opportunity to purchase a BPA on better terms than were available through 2019 and early 2020. For smaller schemes in particular, the curtailment of the transaction pipeline in 2020 should create increased capacity, improved engagement, and more aggressively priced terms.

For any scheme planning to purchase a BPA, consideration should also be given to reviewing the composition of the scheme’s portfolio of matching assets. To the extent that this portfolio is predominantly invested in government bonds or LDI assets, increasing the allocation to corporate bond funds of a suitable duration will better match the movement in BPA prices. With corporate bonds at their current elevated levels, now may be a good time to consider implementing such a change.

|