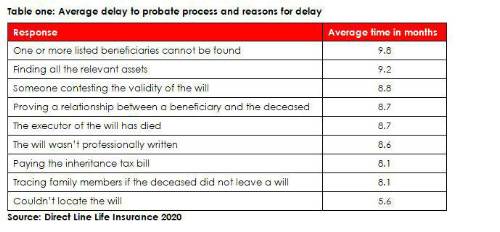

The most common reasons causing issues when settling an estate were; one or more of the listed beneficiaries could not be found (33 per cent), there were difficulties proving the relationship with the beneficiary and the deceased (29 per cent) and the executor of the will had passed away (16 per cent).

If one of these issues arises it could delay the estate being settled by as long as a year. Finding the relevant assets and being unable to find one or more listed beneficiaries is likely to delay the process by more than nine months. The process could face a delay of more than eight months if the if someone contests the contents of the will or if the will wasn’t properly written, as the solicitor will need to prove the relationship between the beneficiary and the deceased.

Probate lawyers report that they have seen a rise in these types of issues, especially increased difficulty tracking down beneficiaries, this is predominantly down to families seeing each other less regularly (47 per cent), children and parents taking different surnames (23 per cent) and families falling out with each other more often (17 per cent).

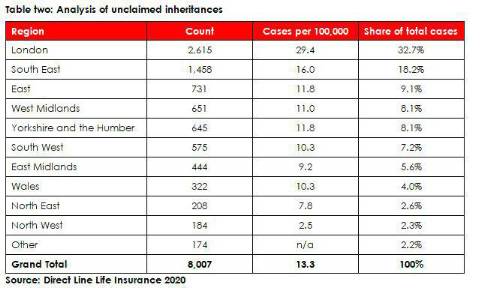

Further research from Direct Line Life Insurance found that there were 2,882 cases of unclaimed inheritance which were more than 20 years old, with the oldest being 46 years old and listed on 16th June 1974. Overall, there were 8,007 cases of unclaimed inheritance recorded in the UK as of September 2020, with an average of six new cases raised every week in H1 2020.

The analysis also reveals that the number of unclaimed inheritances is increasing, with an 18 per cent increase in 2019 compared to 20 years ago and an 11 per cent increase from 10 years ago.

Chloe Couper, Business Manager at Direct Line Life Insurance, commented: “Organising probate can be a very stressful time for families and relatives who have lost a loved one. This situation can be exacerbated by issues which cause unnecessary delays to the process. This research highlights the need to discuss these complex issues with family members and for them to ensure that a will is written at an appropriate time, helping to reduce the likelihood of these issues arising.

“We would recommend that anyone going through this process checks their, or their loved one’s, life insurance policy, as they may be in a position to receive a lump sum which would help ensure legal fees and funeral costs are covered while any probate issues are resolved.”

|