Research from JLT Employee Benefits (JLT EB) reveals that within the FTSE 100, financial services companies support the best-funded workplace defined benefit (DB) pension schemes.

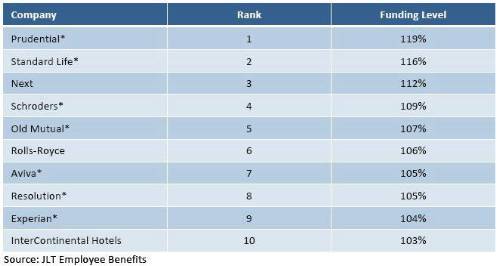

Seven of the 10 best-funded pension schemes in the FTSE 100 are financial services companies* – see table below. JLT EB explains that this is because insurance companies were forced to plug their pension fund deficit in order to comply with the Solvency II regulation, which imposes stringent capital requirements and risk management standards for the European insurance industry.

The research, which analyses the funding position of FTSE 100 defined benefit (DB) pension schemes, also found that their aggregate deficit has improved by £14 billion to £40 billion over the 12 months to 30 June 2013. Meanwhile, the total disclosed pension liabilities of the FTSE 100 companies have risen from £471 billion to £533 billion.

Only 66 FTSE 100 companies are still providing more than a handful of current employees with DB benefits. Of these, only 22 companies are still providing DB benefits to a significant number of employees.

The average pension scheme asset allocation to bonds remains unchanged at 56%. This followed a large increase from 50% the year before. Six years ago, the average bond allocation was only 36%.

Top 10 FTSE 100 companies with the best funded pension schemes overall

Charles Cowling, Managing Director, JLT Employee Benefits, comments: “The Solvency II Directive was initially intended to pre-empt the failure of large insurance companies, but it has also had a positive side-effect on the funding levels of insurers’ pension schemes because reducing the pension scheme’s deficit can improve their core capital ratio.

“Whilst the overall deficit position of the FTSE 100 has been improving over the last year, the funding gap is still significant and funding remains an ongoing challenge for companies.

“The sustained appetite of pension funds for fixed income investments despite their low yield is a reflection of their risk aversion in light of the persisting economic uncertainty and market volatility.

“The fact that even large employers are providing defined benefit pensions to fewer and fewer staff underlines the trend for DB schemes to disappear and be replaced by defined contribution schemes. As the auto-enrolment process unfolds, this is likely to speed up this trend.”

|