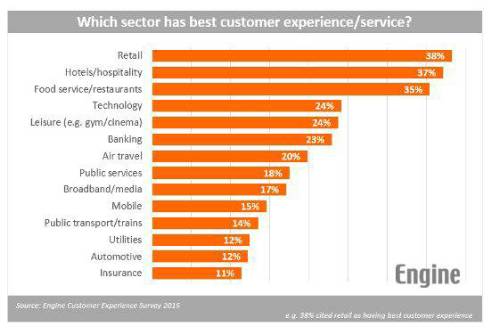

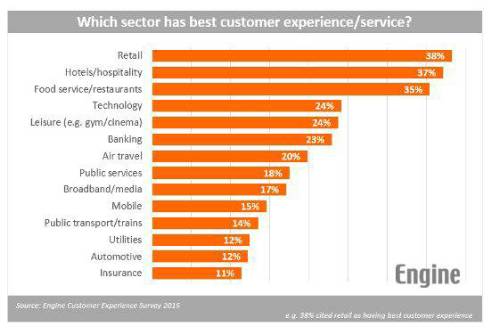

Among the 14 sectors covered in the study, just 11% of respondents cited insurance, followed by automotive and utilities (both 12%). The retail sector ranks 1st (38%) as having the best customer experience. Fellow financial service, banking is 6th (23%).

“Insurance suffers from two key problems in terms of customer experience,” says Oliver King, co-founder of Engine. “It’s a product people are obliged to have rather than want. Plus, on the rare occasions they do interact with the provider, it normally has negative connotations – either going through the sometimes onerous claims process or receiving a renewal notice, often accompanied by an increase in premium. To compound the situation, customers are unaware of the complexity of current underwriting and claims processes, so their expectations of a simple and speedy settlement are high.”

Insurance ranks 11th (16%) in terms of where consumers’ choice of provider is most strongly influenced by the quality of service and customer experience. Banking ranks 4th (26%), while food services/ restaurants (cited by 35%) is the sector most affected by this.

“With strong solvency regulations and restrained by legacy platforms, insurers have been less pressured and able to change,” says King. “However with general insurance customers being actively encouraged to switch each year, the pensions industry shake up and life insurers developing lifestyle propositions, insurance companies need to adapt and respond to the changing industry environment and customers’ expectations. Insurers need only look to financial service stablemates in banking to see the benefits a focus on customer experience can bring.”

Consumers value honesty and efficiency most highly

Openness/honesty is the most valued trait in the way a company provides its customer service and experience (cited by 49% of respondents), followed by efficiency (43%) and reliability (41%). All three of the most valued traits become a bigger factor with age – particularly openness/honesty.

“Insurers can’t afford to think about what’s important to their ‘average customer’ – that person doesn’t exist,” notes King. “Instead, they need to think of the different customer profiles and tailor the experience accordingly for each one. For instance, older people put greater emphasis on the experience being honest, efficient and reliable, while the younger generation put more store on it being flexible and enjoyable.”

Why is customer experience important?

Better customer experience leads to increased revenues, greater likelihood of recommendations, process efficiencies and customer loyalty. King explains: “Businesses can more accurately measure the impact that an improved customer experience has on performance. Clients like Zurich UK, Royal Sun Alliance and MORE TH>N have all used service design techniques which essentially put greater customer focus into designing the experience an insurer provides.”

|