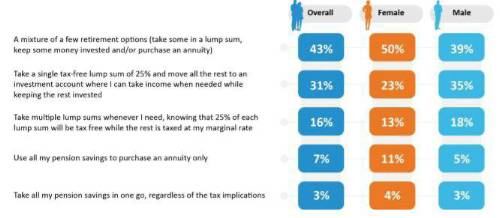

But despite the low appeal of the annuity-only route, nearly half of savers would consider an annuity when combined with other retirement options. Over four in ten (43%) say a mixture of options — including buying an annuity, taking a lump sum and keeping some invested — holds the most appeal when it comes to accessing pension savings. This mixed approach is particularly popular among women (50% vs. 39% men).

“While record low rates have dented appetite for the annuity-only option, our findings suggest that annuities still have a role to play in retirement plans,” said Craig Phillips, head of International, CoreData Research. “Furthermore, the market turmoil unleashed by Covid-19 means that fixed term annuities could hold particular appeal for those seeking a degree of certainty over a specific period.”

Low rates, cited by more than a third (35%) of retirement savers, are seen as the biggest disadvantage of annuities. This is followed by fees and costs (19%), inflexibility (12%) and taxation issues (12%).

Meanwhile, nearly one third (31%) of those saving for retirement think taking a tax-free lump sum of 25% and moving the rest into income drawdown presents the best option when accessing pension savings. Men (35%) are more likely to favour this approach than women (23%).

Less than one in five (16%) would choose to take multiple lump sums whenever needed and just 3% say they would take their entire pension pot as cash.

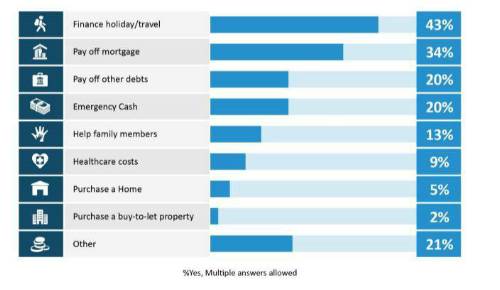

In terms of what investors would use their pension lump sums for, the most popular choice — cited by 43% of savers — is holiday or travel. This is followed by paying off a mortgage (34%), paying off other debt (20%), emergency cash (20%) and helping family members (13%). More women (27%) than men (15%) say they would use a lump sum for emergency cash.

Investors with a financial adviser are more likely to say they would use lump sums for holidays or travel (48%) than their non-advised counterparts (37%). Non-advised investors are more likely to use lump sums to pay off their mortgage (41%) than advised investors (28%).

“These findings may reflect different levels of wealth between advised and non-advised respondents,” added Phillips. “Advised investors may be better off financially and therefore more likely to think they can afford holidays.”

Key Findings

Which of the following is most appealing to you in terms of accessing your pension savings?

What would you use your lump sum amount for?

|