A quarter (25%) of over-50s workers are hoping to profit from downsizing to a smaller home or moving to a cheaper area. A similar proportion (24%) are relying on receiving an inheritance to achieve a comfortable standard of living in retirement, which suggests it’s not only younger generations who count on help from family to support their financial needs.

More than a fifth (22%) are depending on relatives no longer being financially dependent on them – part one of Aviva’s Real Retirement research revealed as many as 1.9 million older workers currently have financially dependent parents or children1.

Worryingly, more than one in ten (13%) or 1.3 million2 over-50s workers say they are relying on a lottery win to afford a comfortable retirement, despite the odds of winning the National Lottery being just one in 45 million3 – a sign of their pessimism about their prospects of otherwise being able to retire in comfort.

Pension saving is secondary to big purchases and living costs

As older workers’ financial futures hang in the balance, many are finding they need to put their earnings towards big purchases or everyday spending instead of pension saving.

Over-50s workers say they reached or expect to reach their peak earnings – or the highest amount of income earned during their lifetime – at the age of 51 on average, with this period lasting for an average of 5½ years. This potentially provides a vital window of opportunity for people to boost their pension savings ahead of retirement. Analysis by Aviva shows if a saver was to put away an extra £100 per month into their pension for the full 5½ years of peak earnings from the age of 51, this could translate to a £25,000 boost to their pension pot at retirement4.

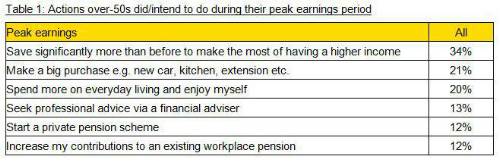

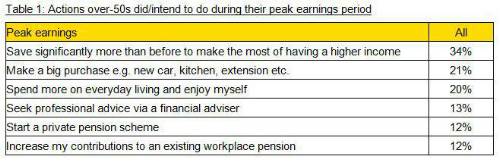

Although a third (34%) of older workers save more during this peak earnings period, a fifth (21%) say they have or would spend it on big one-off purchases such as a new car, kitchen or extension. A similar proportion (20%) have or would spend more on everyday living and enjoying themselves.

Only 12% say they have or would increase contributions to an existing workplace pension during this time, rising to just 14% among those who expect to retire within the next two years.

The cost of living is a key factor disrupting older workers’ saving plans: with inflation at a five year high, a third (33%) of workers aged 50+ say their ability to save is hampered by having no money left after paying for everyday living costs.

Other factors scuppering their ability to save are the need to pay off a mortgage before retirement (felt by 39% of those with a mortgage) and having financially dependent children (18%).

More than 2 million older workers are yet to have taken pension saving seriously

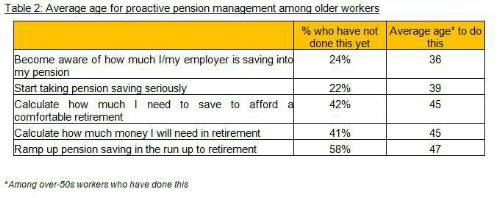

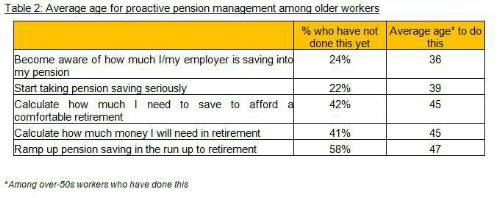

As immediate financial pressures force older workers’ focus away from long-term planning, almost a quarter (22%) or 2.2 million workers aged 50+ say they are yet to take pension saving seriously. In addition, more than two in five have not calculated how much money they will need in retirement (41%) and how much should be saved to afford a comfortable retirement (42%).

Three in five (58%) have not ramped up pension savings in the run up to retirement, including 57% of those aged 60-64 who are close to what was previously the Default Retirement Age.

Based on the experience of older workers, those who have taken action to prepare for retirement tend to do so in their late thirties and forties, with pension saving being taken seriously from the age of 39 on average.

Lindsey Rix, Managing Director, Savings and Retirement at Aviva said: As everyday financial pressures take their toll on older workers, many are postponing retirement planning and are instead relying on factors other than savings – many of which are outside of their control – to afford a comfortable retirement. Even those options that might seem guaranteed, such as making a profit from selling a home, could pose a challenge should economic or market conditions change.

“Wherever possible, retirement saving shouldn’t be left to chance. Although older workers have multiple demands on their income, taking time to understand what needs to be saved in order to afford a good standard of living in retirement and putting more away each month – no matter how small the increase – can make a big difference.

|