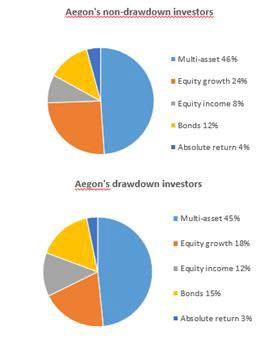

Aegon’s research compared investment choices made by its drawdown and non-drawdown platform investors [i.e. those still saving for retirement], and found they only differed slightly, despite drawdown investors having different demands on their money and generally shorter investment time frames. For those in drawdown, the largest investment flows over the past year2 were into multi-asset strategies (45%), with equity growth second (18%), bonds third (15%) and equity income fourth (12%). This largely mirrors the strategies used by non-drawdown investors who also favour multi-asset strategies (46%), followed by equity growth (24%), bonds (12%) and equity income (8%). Aegon’s research compared investment choices made by its drawdown and non-drawdown platform investors [i.e. those still saving for retirement], and found they only differed slightly, despite drawdown investors having different demands on their money and generally shorter investment time frames. For those in drawdown, the largest investment flows over the past year2 were into multi-asset strategies (45%), with equity growth second (18%), bonds third (15%) and equity income fourth (12%). This largely mirrors the strategies used by non-drawdown investors who also favour multi-asset strategies (46%), followed by equity growth (24%), bonds (12%) and equity income (8%).

Investors are replacing some equity growth with equity income, and Neil Woodford’s fund is dominating the cash flow figures in the equity income sector. However, most are using multi-asset strategies to manage the balance between risk and return.

Aegon’s analysis suggests that retired investors using multi-asset investments are reducing risk. Across a sample selection of six multi-asset fund ranges, most drawdown investors are in funds at risk levels three or four on Distribution Technology’s 1-10 risk scale, compared to most non-drawdown savers investing in risk profiles four or five3.

Aegon does however raise a note of caution. Investors have experienced broadly positive markets in the two years since the new pension rules were introduced, but a significant market shock could wipe years off retirement income unless investment strategies are de-risked to meet the particular requirements of retired investors.

Nick Dixon, Investment Director at Aegon, said: “Drawdown’s popularity has rocketed since the pension freedoms, but retirees’ investment choices are still adjusting to the needs of those that choose to remain wedded to the markets in retirement. Drawdown investors, are largely favouring tried and tested brands and investment strategies over newer, more tailored options.

“As a result, there is a mis-match between the long-term growth objectives of many of the strategies being used, and the near-term income needs of retirees who use them. Retirees are also now more exposed to market highs and lows than they have ever been.

“While most drawdown investors have benefited in the largely buoyant markets witnessed since the new rules came into force, the strategies used haven’t yet been tested by a Dotcom or credit crunch style market shock. Our hope is that the market evolves further before one occurs.

“In an environment where there is not yet an accepted wisdom about the sorts of investment strategies that should be used in retirement, advisers have an opportunity to create real value by providing investment advice for an expanding list of drawdown clients. We offer a range of drawdown funds aimed at helping advisers do just that, including funds that offer a guaranteed income for life. There’s no such thing as a watertight strategy, but helping clients to create sustainable incomes in a market still in its infancy will prove an invaluable service at a critical time.”

|