In the five years since pension freedoms were introduced in April 2015, pension holders have withdrawn a mammoth £35.44bn (£8.18bn was withdrawn in 2018/19, £6.65bn in 2017/18, £6.45bn in 2016/17 and £4.35bn in 2015/16).

Looking at the last three months in more detail, the data shows a 23% increase in the number of people withdrawing cash compared to the same period in 2019 (284,000 people) and a 19% increase in the value of payments (from £2.06bn in the first three months of 2019 to £2.46 billion this year).

Andrew Tully, technical director at Canada Life, commented: “There can be no question that the pension freedoms have been hugely popular, going by these latest numbers. People have been attracted by the ability to use their pensions like cash machines, but individuals need to tread carefully and be wary of triggering unintended consequences. For example falling prey to scams, paying larger than necessary tax bills, or limiting the amount you can subsequently save into a pension if you plan to top up any withdrawals.

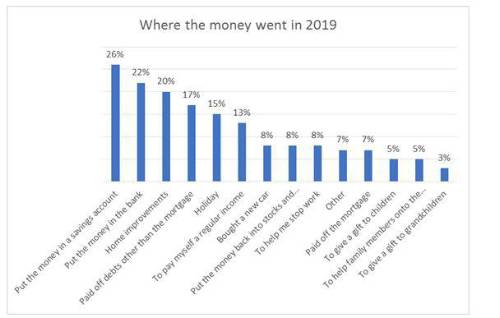

“Our latest research from March shows many people are simply withdrawing cash from a pension to save the money in a bank or invest elsewhere. Withdrawing taxed lump sums from a very tax efficient pension environment to put on deposit or save into stocks and shares makes no sense whatsoever. People are paying significant tax on withdrawals, as many are withdrawing pension money while still working. In addition, money within pensions can be passed on to family in a very tax efficient way, and normally free of Inheritance Tax, so many people should be leaving their money in the pension until it is required for income or to meet other clear spending commitments.”

Plans for 2020

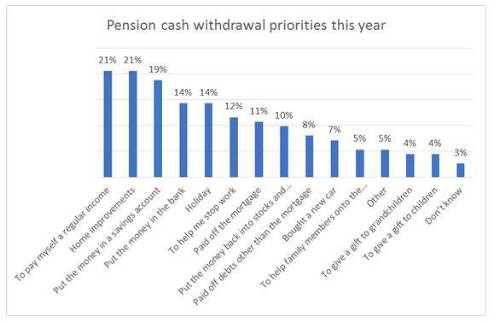

The research also asked the over 55s with private pensions if they had plans to withdraw taxed lump sums from their pensions this year. Less than one in 10 (or 6%) said they either had already taken some cash or planned to so do at some point this year. Nearly nine in 10 said they wouldn’t be dipping into their pension this year while 6% didn’t know.

Andrew Tully commented: “It looks like the current economic climate has put the temporary brakes on any plans for people who were looking to dip into their pensions again this year. But this may change as the reality of lockdown life hits home with many people having lower income due to being furloughed. Being pragmatic about the current volatility we are experiencing and thinking ahead is crucial. Withdrawing cash when markets are so fluid, more than likely crystallising losses in the process and paying tax simply for the money to sit in a bank account is clearly not sensible.”

Changes needed to the Money Purchase Annual Allowance (MPAA)

Andrew commented: “It may be tempting for some over 55s to dip into their pension to help them through any short-term financial problems. Some clients may simply access some of their tax-free cash, but for those who take taxable income, the MPAA will be triggered.

“The MPAA has long been viewed as an unreasonable restriction, limiting future pension contributions to £4,000 a year once a pension is flexibly accessed. People being able to take some of their pension in this unprecedented situation is hugely beneficial. At some point, some kind of normality will return. And in future clients may want to make up for those withdrawals by paying in more to their pension. It seems bizarre the rules may restrict their ability to do so. The last few weeks have seen dramatic changes to many rules. Scrapping or amending the MPAA is minor in comparison, but nonetheless it is a change the Government should make.”

Source: Canada Life research among 393 people aged 55+ who accessed their pensions in 2019 via taxed lump sum withdrawal. Note respondents could tick all that apply.

Source: Canada Life research among 393 people aged 55+ who are planning to or have accessed their pensions in 2020 via taxed lump sum withdrawal. Note respondents could tick all that apply.

HMRC Latest Pension reedom Figures

|