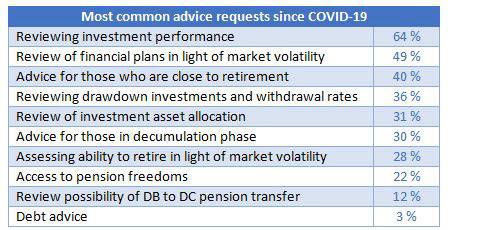

The most common client enquiry was a review of investment performance, with nearly two-thirds (64%) of advisers having been contacted about this since the beginning of the crisis. Reviewing financial plans in light of current market volatility was also a common request, with half (49%) of advisers saying they have had enquires on this.

Aegon research: What are the most common advice requests at present?

The research also looked at whether advisers have seen a change in the way their clients think about investments and their relationship with money. Half of advisers (48%) said clients have seen the current market performance as an opportunity to invest for the future. However, three in ten (31%) said their clients are more fearful and reluctant to invest in the medium term and a further quarter (23%) said their clients have concerns about locking money away.

Steven Cameron, Pensions Director at Aegon, comments: “There are lots of reasons why people seek financial advice and demand is often driven by a change in personal circumstances or influences from the external environment. For many, the coronavirus pandemic ticks both these boxes. Stock market turbulence following the onset of the coronavirus has no doubt been concerning for individuals, and with some facing disruption to employment, advisers can play a hugely important role in navigating clients through the issues and providing real value in the crisis. Without access to advice, there’s a risk people will take panic action that might not be in their best interests and could do significant long-term harm, particularly at important life stages such as retirement.

“The research also shows current market volatility has prompted some individuals to look for investment opportunities. Those in the accumulation phase with a long-term savings horizon will be hoping that over time markets will recover and might seek financial advice for opportunities to invest while share prices are low. For others, particularly those with shorter time horizons, the pandemic may have reduced their risk appetite as they become more cautious in their investment choices.

“While the coronavirus is first and foremost a health crisis, it is also having significant implications on personal finances and the economy. Demand for advice will inevitably remain high as the market reacts to the economic fallout from this global pandemic.”

|