By Nicholas Boll, Senior Underwriter Agriculture, Swiss Re and David Maeder, Product Manager Agriculture, Swiss Re By Nicholas Boll, Senior Underwriter Agriculture, Swiss Re and David Maeder, Product Manager Agriculture, Swiss Re

Satellite technology is a game-changer for the agricultural insurance industry.Today, data on the health of crops in the vast, remote agricultural areas like in Russia, the Ukraine, Australia or Brazilc an be viewed and scrutinised from a PC screen in Zurich or London in almost real time. The result for the insurance industry is a new generation of agricultural insurance protection which is simpler, more efficient to administer and equally valuable to developing agricultural markets and to established markets in Europe and the Americas.

Insurers have good reasons to develop agricultural insurance. Agriculture production is growing and related investments need protection. Global agricultural insurance premiums were estimated at USD 23.5 billion in 2011 and will likely increasefurther. The lion's share of this premium is generated in the US and Canadian markets, while a combination of growing risk awareness, government support and technological advances mean that the BRICS, Eastern Europe and Africa are catching up.

Innovation is a key contributor to growth in agricultural insurance. Mobile technologies are changing the way insurers reach out to isolated farming communities and are helping to increase insurance penetration in emerging markets. The industry has also seen widespread use of automated weather stations and index-based insurance products, which bring the advantage that claims can be settled more efficiently.Satellite data pushes this concept forward because it moves from being able to monitor specific localities to providing data for whole regions or even countries.

How it works

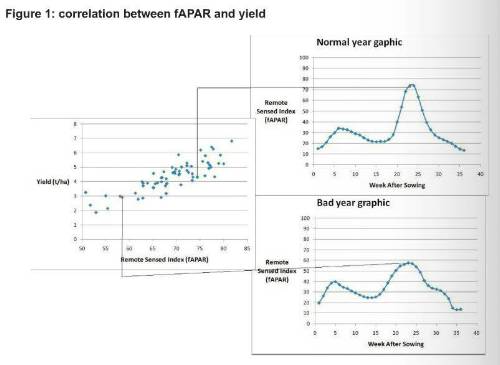

Satellite-based agricultural insurance worksbecause there is a good correlation between the energy uptake by growing plantsand the eventual yield at the end of a growing season. (See figure 1)

For a larger view of the above table click the image

Satellites measure how much energy plants are absorbing from the sun for photosynthesis using a parametercalled the fraction of Absorbed Photosynthetically Active Radiation, or fAPAR. This measurement is one of the50 Essential Climate Variables used by the UN Global Climate Observing System to characterise the climate on earth.

The fAPAR, which is an index between 0 and 100, is calculated for each measurement unit (pixel)on a map. In the types of insurance Swiss Re and its partners are developing, each unit has a side lengthof about 250m.Higher resolutions of 10m per pixel are available. However, 250m is sufficient for a cost-effective and reliable data set.

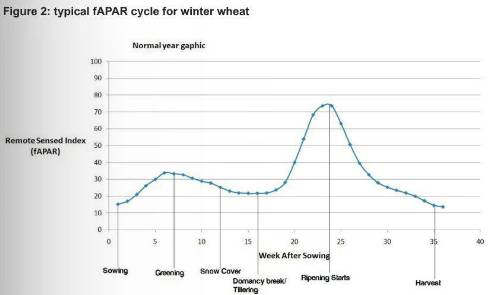

The satellite data, which is delivered in 10-day cycles to ensure at least one cloud free, reliable shot, is then matched to the type of crop being insured. Crops absorb definite amounts of sunlight in the various phases of their development. To illustrate this, we can take the example of winter wheat in Krasnodar, in the black earth region of Southern Russia. The seeds are sown in October. At this point, the indexed fAPAR is very low because the field is not absorbing much energy.However, once the seeds germinate, break the surface of the field and start absorbing sunlight, the fAPAR rises. Whenthe first snow covers the fields, the wheat becomes dormant, awakening in spring, when the snow recedes. At this point,the wheat growsrapidly and becomes most active, absorbing large amounts of energyand leading to very high fAPAR values. (See figure 2).

For a larger view of the above table click the image

Setting the insurance trigger

Because of the goodcorrelation between fAPAR data and the eventual yield, it is possible to definea parametric index, which can beused as the basis for the insurance cover. If the fAPAR index on a winter wheat field is too low during the spring, the grower and insurer have a strong indication that many of the plants did not survive the winter. This might trigger an insurancepayout. Moreover, when the fAPAR value fails to reach a pre-determined level in summer, this is a strong indication of a reduced yield. Here again, this could potentially trigger an insurance payout.

Because of the large area covered, this insurance is not limited to a single farm, but could be taken out for an entire region in the shape of a macro index product.

Currently, satellite-based insurance products are more suitablefor large-scale losses from events like flooding, droughts or heat waves. For more localised events, such as hail storms where half a field can be destroyedwhile the other half is perfectly fine, a traditional indemnity type cover based onlocalised assessment remains the most economically viable option.

A well-designed satellite-based index insurance scheme can give a substantial cost benefit to the insurer. The data collection process is more efficient; inspection and loss adjustment time and costs are lower; and, there is less fraud. These benefits offset for higher initial implementation costs and a certain amount of basis risk.

Finally, the lower costs and greater geographical coverage make these types of products ideal for high-growth emerging markets, where insurance penetration is typically quite low, loss assessment is made difficult by distance and a lack of infrastructure, and food security is an issue increasingly receiving government support.

|