|

|

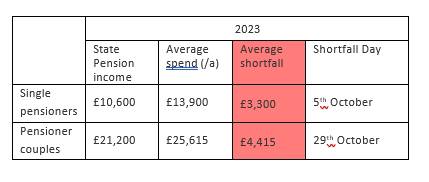

The average single pensioner spends the equivalent of a full annual State Pension on Thursday with nearly three months of the year left to go. State Pension Shortfall Day arrives on 29 October for two-person retired households highlighting the extra financial burden shouldered by single pensioners in retirement. State Pension set for second successive substantial increase in boost to pensioners’ income. |

With nearly three months of the year still to go, this Thursday marks State Pension Shortfall Day – the point in 2023 when the average single pensioner would have exhausted the full State Pension (£10,600 in 2023-24) and be reliant on private pension income or other savings to bridge the gap.

According to the latest ONS figures, the average single pensioner spends £267.30 a week or around £13,900 a year. It leaves a shortage of £3,300 a year – or a period of around three months with the State Pension running out on 5th October 2023.

Two-person retired households spend proportionately less per person on average, with many expenses shared but not doubling in price. Their mean expenditure comes in at £492.60 a week or £25,615 a year.

If both retirees have a full State Pension providing annual income of £21,200 that leaves a deficit of £4,415 over the course of the year with State Pension Shortfall Day falling on 29th October. Stephen Lowe, group communications director at retirement specialist Just Group, commented: “At a time when the State Pension is under the spotlight, State Pension Shortfall Day sets out how the income it provides matches up to the amount the average retiree spends over the course of a year. “Although the State Pension looks set to be boosted by a second significant increase it is unlikely it will provide more than a very basic income. ‘Shortfall day’ is a notional date given State Pension payments are spread through the year, but it highlights the need to build up extra pension or other savings to provide that valuable extra income in later life.”

“This year’s data also uncovers the financial disadvantage that single pensioners face as they tackle bills, repairs and everyday costs on one income. It’s a difficult conversation to have but as couples plan for retirement they would do well to remember that one of them is likely to outlive the other and factor this into their financial arrangements.” |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.