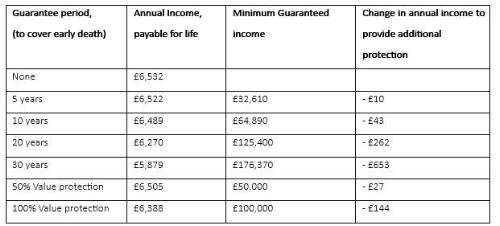

In one example, the margin between no guarantee and a 20-year guarantee is just a 4% reduction in annual income, with a £100,000 annuity securing an income of £6,532 vs £6,270, a reduction of £262 a year. The 20-year guarantee will return income of at least £125,400, irrespective of what happens to the customer.

Nick Flynn, retirement income director at Canada Life commented: “As annuity rates have improved so has the cost of the death benefits available. No longer do clients need to trade off a big drop in income to provide valuable guarantees. The reduction in income from choosing a longer guarantee period which effectively provides a ‘money-back’ guarantee, is now so narrow as to cost peanuts, so it’s completely bonkers not to consider some guarantees to provide additional certainty.

“Now one of the biggest barriers to annuities, ‘I won’t get my money back if I die early’, can really be challenged and guaranteed periods need to be explored. People considering annuities as part of their retirement income plan should seek the help and support of a specialist broker or regulated financial adviser. That will help ensure all options are considered in the rounds before making any irreversible decisions.”

How the costs compare - £100,000 purchase price

Source: Canada Life annuity rates as at 11/04/2023. Healthy life aged 65, average postcode

How the annuity guarantees choices work in practice

No guarantees. Immediately on the death of the customer, the income stops.

Spouse benefits. A customer can choose to pay anywhere between 0% and 100% of the original annuity income to a spouse, subject to a reduction in income. Upon the death of the spouse, the income stops.

Guaranteed periods. A customer can opt for any income guarantee period between 1 year and 30 years, again, subject to a reduction in the income received. In the event of the death of the customer, the income will continue to be paid to a spouse or beneficiary for the remaining guarantee period.

Value Protection (VP). A customer can choose to protect the capital purchase value of the annuity, up to 100%, again, subject to a reduction in annual income. Upon the death of the customer, the difference between income received to date and the ‘value protected’ amount is paid to the spouse or beneficiary, in the form of ongoing income or the value can be commuted as a lump sum.

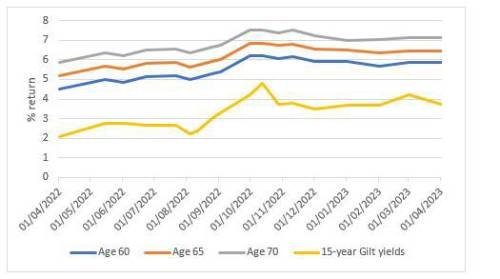

How annuity rates have changed over the last year

Source: Canada Life annuity rates over time, as at 01/04/2023

|