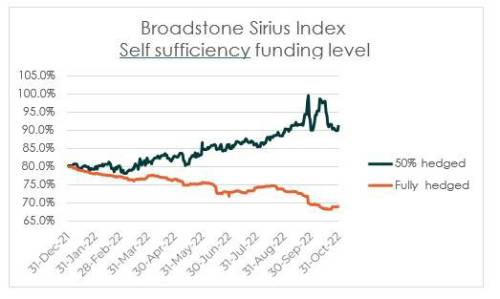

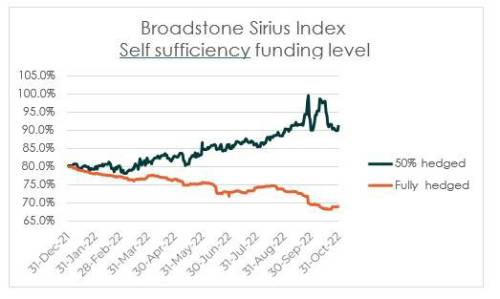

The Broadstone Sirius Index found that market stability through November and December saw both its hedged and unhedged schemes steadily improve funding levels and reduce deficits after previous months of significant volatility.

As with the rest of 2022, the impact of rising interest rates has impacted asset valuations less for the 50% hedged scheme. This resulted in a larger funding improvement for this scheme over the last two months, compared to the fully hedged scheme.

While both schemes started the year at an 80% funding level, the scheme with only 50% of liabilities hedged ends the year at 95% compared to 71% for the fully hedged scheme’s funding position.

Crucially though, both model schemes have reduced their deficits as assets, liabilities and therefore the deficit are all much smaller now. In particular, the buy- out deficits end the year much lower than the £18.5m where they started it. This has decreased to £13m where liabilities were fully hedged and £6m where only 50% of liabilities were hedged.

Nigel Jones, Head of Consulting & Actuarial at Broadstone, said: “After a volatile year, especially through the Autumn period, it is great to see that self-sufficiency funding levels have stabilised towards the end of 2022.

“This period of relative calm is now a useful time for schemes – whether they have hedged previously or not – to assess the impact of the turbulence we’ve seen in long-dated gilt yields.

“Trustees and sponsors should be using this time to engage with their investment consultants and LDI managers to understand the impact on assets as well as reviewing their investment strategy and journey plan for the revised deficit.

“The dramatic reductions in the gaps to buy-out for sponsors of all shapes and sizes is further good news and consideration should be given to preparing for an approach to the insurance market in many cases.

“However, the immediate macro-economic environment remains murky. Trustees and sponsors should be mindful of the risks caused by any future falls in asset values stemming from rising long-term interest rates and/or impending recession.

“2022 may well have been a good year for the deficit size of schemes but many risks remain.”

|