Analysis of last week’s ONS Household Disposable Income and Inequality figures shows the mounting inequality among Britain’s pensioners since the introduction of Pension Freedoms in April 2015.

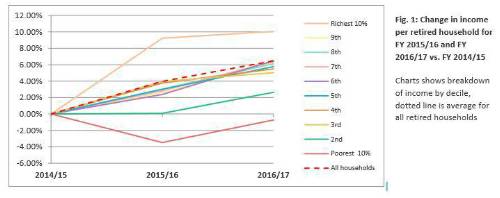

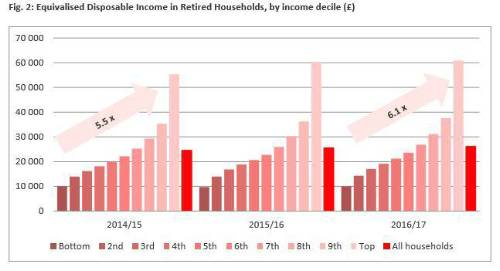

It indicates that the overall rise in household income for retired households masks the underlying picture of the rich getting richer and the poorest losing out, thereby disguising the financial pressures many pensioners face. The figures reveal that from FY 2014/15 to FY 2016/17 income for the poorest one million pensioners fell (0.73%) while the richest one million pensioners were ten percent better off.

The ONS, which itself acknowledged the rise in pensioner income inequality, published this data just days before the Government announced the second reading of the Financial Guidance and Claims Bill will be on 22 January. The Bill will decide how best to ensure everyone knows about the free government guidance service designed to help people decide how best to use their pension savings (including those who are vulnerable to scams) – a decision that’s become increasingly complex since the introduction of Pension Freedoms.

Income for the poorest retired households (the lowest decile) fell by £73 per year (-0.73%) but income among the richest pensioner households (the highest decile) grew by £5,564/year (+10%) – making the average income gap between these two groups £50,898/year. holds have more than 6 times the income of the poorest pensioner households, who still fall someway short of the £14,300 minimum income requirement identified by the Joseph Rowntree Foundation2.

Most of the changes can be attributed to fluctuations in pension and investment income retirees received. In FY 2014/15 the poorest ten percent received £1,639 from pensions or annuities and £400 from investments. That dropped to £1,449 and £259 in FY 2016/17. Those figures increased from £34,709 and £7,247 to £39,507 and £10,374 during the same period for the richest ten percent.

Commenting on the research, Stephen Lowe, group communications director at retirement specialist Just Group said: “These figures show that for millions of people the pensions crisis is not a thing of the future, it is happening now. While we often hear about how well the ‘Baby Boomers’ are doing, this focus on the wealthiest ignores another very serious problem. For those who have least, how they use their pension pot in retirement can make the biggest difference.

“The Financial Guidance Bill going through Parliament could help resolve this glaring omission from the Pension Freedoms policy – ‘what to do about those not getting advice or help?’. The Bill’s proposal to automatically enrol everyone into free impartial guidance will equip people to make better informed decisions and help to prevent people from being scammed, paralysed by choice or following the path of least resistance into uncompetitive and perhaps ill-suited products.

“People naturally disposed to taking professional advice may choose to opt out of free guidance but for the many millions of people who don’t currently receive help, automatic enrolment into guidance could be a game changer.”

|