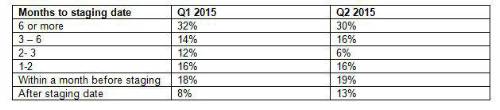

Of these employers, 19% contacted NOW: Pensions within a month before their staging date while 13% left it until after their staging date had passed.

At the other end of the spectrum however, 30% of firms signed up six months or more ahead of their staging date. Nearly a fifth (16%) took action between one and two months ahead of their staging date, while 6% took action two to three months ahead of staging. A further 16% signed up with NOW: Pensions between three and six months in advance of their auto enrolment deadline.

Morten Nilsson, CEO of NOW: Pensions said:

“So far this year a good number of employers are planning ahead, but those coming on board early are typically receiving support either from intermediaries or payroll providers. However, our research shows that as time goes by, an increasing number of smaller companies will be navigating auto enrolment without the benefit of an expert guide.

Many could face fines if they are late either through lack of knowledge or because they believe their current provider will accept them, which they may not.”

Research* NOW: Pensions recently conducted with firms yet to stage revealed that over one company in ten (12%) plans to search the market themselves, up from just 4% of firms surveyed in 2014. At the same time, a staggering 84%** of IFAs are concerned that employers lack the knowledge to make informed decisions on the appropriate auto enrolment solution for their employees.

Nilsson continues: “To support these firms, and prevent them making an uninformed decision which could have a long-term impact on the financial security of their employees, pension providers need to be clear about whether they will accept these firms and The Pensions Regulator needs to drive awareness of the high quality providers available.”

For employers that have missed their staging date, NOW: Pensions has put together a simple five step guide to help them get back on track

|