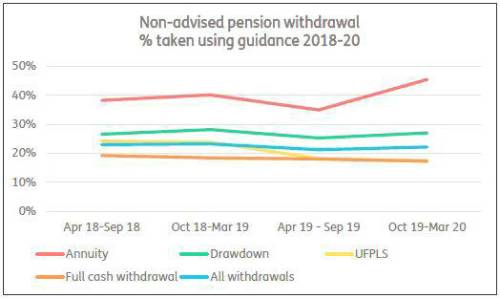

Analysis of Financial Conduct Authority figures by retirement specialist Just Group shows efforts taken by the government and regulators so far – such as TV advertising, reworking ‘wake-up’ packs and improved signposting to Pension Wise – have not increased the proportion of unadvised pension savers taking guidance.

The entitlement to free guidance is the key consumer protection measure introduced in 2015 to help savers with defined contribution schemes make informed decisions and avoid scams.

The FCA figures show that only 94,274 of the 434,407 defined contribution pensions first accessed in 2019/20 – just over one in five (22%) – without regulated advice were taken after using the guidance service.

“The vast majority of those who could benefit the most, those without professional advisers, are missing out,” said Stephen Lowe, group communications director at Just Group.

“The government wants taking guidance to become ‘the norm’ but that will require a four-fold increase in usage on current levels. Instead of more tinkering, which is not working, we need a transformational policy such as automatically enrolling pension savers into guidance as we do into workplace pensions.”

MPs on the Work & Pensions Select Committee recently called on the government to set out a plan for making guidance the norm and a timetable for achieving its ambition.

The FCA figures show that for pension pots accessed without advice in 2019-20, the proportion taking guidance was:

• 18% of the 290,696 pots that were full cash withdrawals,

• 26% of the 70,934 pots placed into drawdown,

• 18% of the 21,429 pots accessed via UFPLS,

• 40% of the 51,348 pots used to buy annuities,

• In total, only 22% of the 434,407 pots were taken after receiving impartial guidance.

Stephen Lowe said that although widespread concerns about low guidance usage dated back to the creation of Pension Wise in 2015, there was no evidence the proportion of savers receiving guidance was improving.

“Attempts have been made to increase guidance take-up by showing TV ads or rewriting pension letters but there has been no upturn in usage levels,” he said.

“The latest idea is the so-called ‘stronger nudge’ but we share the concerns of consumer groups that the results showed only a marginal improvement and not the dramatic shift required.

“Automatic enrolment into Pension Wise appointments from age 50 builds on existing successful pension policy,” said Stephen Lowe. “Once guidance becomes a normal part of the process to accessing pension benefits then most people will stick with it rather than opt out.”

|