In the first extensive piece of research YouGov has carried out among pension holders since the new rules came into force, the quarterly Pensions and Annuities Tracker report finds that fears the changes to annuities would lead to a stampede to buy fast cars and go on luxury holidays have proved to be unfounded.

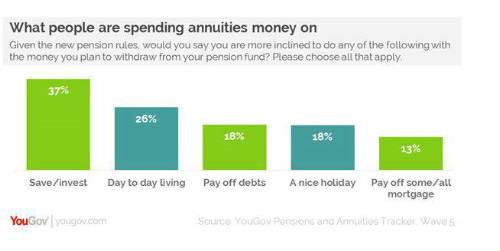

The study shows that although saving and investment is the most common outlet for the money (37%), over a quarter (26%) are using it for day to day living expenses – a sign that many are using the windfalls to top-up their income. Despite concerns that the new rules would lead people to “blow” their annuities, as many are using the money to pay off debts as go on holiday (both 18%).

Instead, YouGov’s report shows that in the first few months since the new regulations came into force, pension holders have been relatively careful. Well over half (55%) of over-50s with pensions have yet to withdraw anything from their funds.

The research shows that many are taking a considered approach to taking money out. With the new rules allowing holders to withdraw a quarter of their annuity tax free, the report finds that around one in four (27%) have taken less than 25% and half (50%) have taken out precisely 25%. The research finds that one in ten (10%) have opted to pay tax by withdrawing more than 25%.

Jake Palenicek, Director of Financial Services at YouGov, says: “When the new annuities rules were announced there was a fear that people would blow their pensions on fast cars and extravagant holidays, leaving very little to see them though their retirements. However, the minority that have taken advantage of early withdrawal so far have been careful, using it for investments or day-to-day living.

“Very few have taken out amounts that take them over the tax-free threshold implying they are thinking carefully about how much to use. Of course, this is the first crop withdrawing under the new rules and it may be that once the rules become more firmly established people take the handbrake off and start spending more on treats and luxuries. The initial response suggests that people in or approaching retirement are far too fiscally responsible for that, though.”

|