New research from The Green Insurer, reveals that 15% of motorists are currently considering giving up driving over the next 12 months as a direct result of the rising costs associated with owning and operating a car.

Any decision to give up their car will heavily impact the lives of many of these motorists, with two in five (40%) saying that the decision may result in them having to change or give up their current job. One in five (18%) motorists will see the surrender of their car dramatically decrease their own independence or that of someone they care for, while a quarter (24%) of people admit that they currently depend heavily on their car for their social life and to see family and friends.

The findings reveal that rising car insurance premiums are a real concern for over a half (51%) of all car owners, with motorists describing themselves as “very worried” (11%) or “quite worried” (40%) that the escalating prices of car insurance will ultimately force them to stop driving and give up their car. Two per cent of respondents said they had already taken the decision to give up driving due to increased insurance premiums.

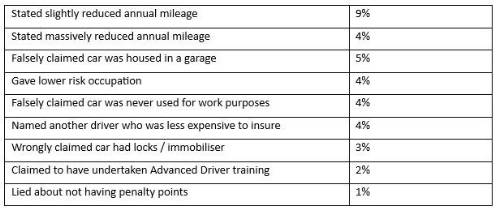

In an effort to try and reduce their car insurance premium a concerning one in five (19%) car owners admitted to stretching the truth or not disclosing certain information when renewing insurance for their vehicle. Such inaccuracies included giving a reduced annual mileage (9%); falsely stating a car is housed in a garage (5%); wrongly stating their car is never used for work (4%) and putting car insurance in the name of a driver who would attract a lower premium (4%).

Table of “inaccurate information” given by owners to try and get a reduction in their car insurance premiums

The findings reveal that the number of motorists who may be tempted to stretch the truth when their car insurance is next up for renewal is only likely to increase with 16% of respondents saying they believed they would be tempted and a further 15% saying they didn't know if they would opt for complete transparency. Giving a slightly reduced annual mileage (18%) and falsely claiming the car was parked in a garage (13%) were stated as being the most likely fields where owners would provide inaccurate information if tempted to do so.

Paul Baxter, CEO, The Green Insurer, said: “Driving habits are changing across the UK as consumers look to cut down on unnecessary journeys, however our findings reveal that many people still rely heavily on their cars to enable them to work or to continue their role as a carer for someone.

|