-

More than 2.5m pension pots may be going unremembered

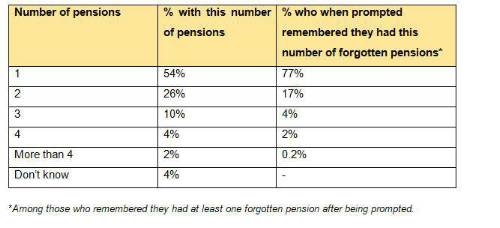

Among those with a forgotten pension, the majority believe they have misplaced one pot (77%), although 17% think they have forgotten about two and 6% have forgotten three or more.

According to Government figures, there is an estimated £400m in unclaimed pension savings3. At the same time, almost three in five (59%) UK adults are worried about not having enough money to last them in retirement4.

Although tracking down a lost pension can provide a valuable boost to retirement income, those who delay could receive a smaller amount than expected. Forgotten pensions may have been subject to charges and not invested in the best way suited to the policyholder, making it worth less than it would have been if it was actively managed.

This new research comes after Aviva revealed the lack of engagement around pensions earlier this year. More than a quarter of savers (28%) admitted to never reviewing their retirement savings, while almost a fifth (19%) of those with a pension said they review it less than once every 5 years5.

Aviva also revealed that since the introduction of auto-enrolment over three years ago, the number of pension savers who are unaware of their fund choices or have never reviewed them has risen to almost 1.5 million people or 15% of private sector employees, up from 9% at the start of 20136.

Andy Curran, Managing Director, Corporate and Business Solutions at Aviva, said: “It’s unsurprising that so many people have pensions they have forgotten about. The ‘job for life’ is now a distant memory with people much more likely to change employer on a regular basis. With auto-enrolment doing such a great job of getting more people saving for retirement, we are likely to see the number of pension pots that people hold increase further as each time a person gets a new job they get a new workplace pension. This is why Aviva is now working to help create a pensions dashboard – a platform where people will be able to see all their pensions in one place.

“People need to be aware of the potential risks of having a number of different pension pots with small amounts of money in each. It’s likely that there will still be charges taken out of those pots for their management and administration and that can have implications if you are no longer contributing into them.

“Consolidating all your pension pots into one place can have its advantages, but needs to be looked at carefully as some pensions come with valuable guarantees that could be lost. Having access to an online tool that shows all your pensions in one place should help savers to be more engaged with their pensions and see what kind of retirement they may achieve.”

Aviva has this week launched its new pension consolidation service, allowing customers to bring their savings together in one easy-to-manage pension pot. This is in line with Aviva’s auto-enrolment (AE) Pre-Review report, carried out to help inform the Government’s own review next year. As part of ten recommendations to maintain and build on the success of the first four years of AE, Aviva believe Government should officially encourage consolidation of small pension pots of £10,000 or less and permit “without consent” transfers of contract-based workplace pensions, so long as savers are no worse off.

If you have a pension you’ve forgotten about, contact your provider or visit the Government’s pension tracing service here.

|