There’s been a sharp increase in economic inactivity in the UK since the beginning of the Covid-19 pandemic in 20201, particularly among people over 50. Leaving the workforce is often necessary, perhaps due to ill health or caring responsibilities. It can also be a lifestyle choice that works well for an individual’s circumstances. However, new analysis from Standard Life, part of Phoenix Group, shows the potential retirement consequences of taking time out of the workforce, or leaving it entirely before a more traditional retirement age.

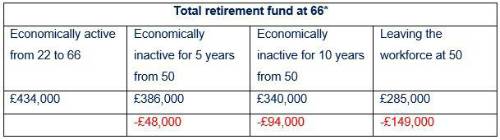

Standard Life found that someone who started working with a salary of £25,000 per year and paid the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £434,000 by the age of 66. However, if they took five years out of the workforce at the age of 50, this could fall to £386,000 - £48,000 less.* Someone who took 10 years out could have £94,000 less (£340,000) at 66, and someone who left the workforce at 50 and didn’t return could end up with £285,000 in their pot, almost £150,000 less than if they’d continued to work until 66. This also assume the pension pot is left untouched until the age of 66, so could fall even lower if accessed earlier. The figures are not adjusted for inflation.

*if beginning working with a salary of £25,000 per year and paying 3% employer and 5% employee monthly contributions into a workplace pension at the age of 22, assuming 5% investment growth, 3.50% salary growth and a 1% investment charge

Gail Izat, Managing Director for Workplace at Standard Life, part of Phoenix Group said: “The number of people neither working nor actively seeking work in the UK has increased recently, particularly among the over-50’s. Though Ill-health and disability are cited as common reasons2 for people being economically inactive, the issues behind the ‘Great Resignation’ trend are complex and diverse.

“Research from Phoenix Group’s longevity think tank Phoenix Insights - comparing attitudes to work in the UK with Germany and the US - found over 50’s were typically less positive about their experience in the workplace.3 For employers looking to retain their later-career employees, or keen to attract skilled older workers back into the workforce, considering a flexible working policy including flexible hours, home working and carers leave could help to create an age-inclusive environment.

“While not everyone may be able to continue in work, our analysis shows that taking extended time out from work can lead to people having significantly less in retirement. Factors driving the disparity range from the power of compound investment growth, the fact that people are likely to be better paid later in their career, and that pension contributions in people’s fifties and sixties can be highly valuable. Through the use of targeted communications, as well as giving people the option of seeing all their finances in one place through tools like open finance, employers can help people gain an idea of the standard of living they’d like in retirement, and the pot size necessary to achieve it. This can then help them to make a decision about when it’s right for them to retire or leave the workforce, as well as boosting their financial wellbeing throughout their career.”

|