A report published by Policy Exchange has found that 11 million people are at risk of entering ‘pensioner poverty’ when they retire, with the report urging the Britiish government to make it compulsory for people to save for later life.

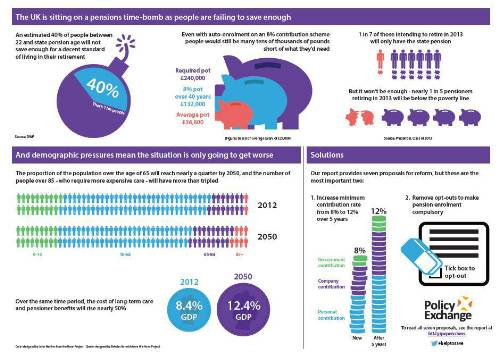

The report shows that an individual earning the average wage of £27,000 will need to save over six and a half times more than they currently do to generate the government’s recommended retirement income of £16,200. The average pension pot is estimated to be just £36,800, which on current annuity rates is enough to generate a retirement income of £1,340. The paper says that an average earner would need a pot of £240,000, assuming they receive the full single tier pension.

The report says that one way to defuse the demographic time-bomb is through a new ‘Help to Save’ scheme. This would make it obligatory for people to save for their retirement by removing the opt-out in the existing auto-enrolment scheme while also increasing individual contributions to pensions as their incomes rise over time.

The paper supports the recent introduction of auto-enrolment but warns that even with 8% contributions flowing into a pension on a regular basis, people will not be able to save enough for their retirement. Over a 40 year contribution period, using the 8% contribution rate, someone earning £27,000 would likely be able to save around 55% of what they need to generate the target retirement income. That figure drops to 40% if that individual takes their tax free lump sum when they retire.

Latest figures show the urgent need to act swiftly:

• The proportion of people aged 65 and over is projected to increase from 17% to 24% over the next 50 years.

• The proportion of people aged 85 and over is projected to treble from 2% to 6% in the next 50 years

• Long term care and pensioner benefits will total some 12.4% of GDP in 50 years time –nearly a 50% increase compared to today’s level of 8.4%.

• 1 in 7 people who retired in 2013 intended to rely entirely on the state pension. While 1 in 5 pensioners will be below the poverty line.

‘Help to Save’ would work by:

• Ending the opt-out currently available to private sector employees under the government’s auto-enrolment scheme unless the individual can show they have sufficient funds already in their pension pot. To date only 1 in 10 employees have opted-out but this level may rise as smaller firms are incorporated into the scheme.

• Including an automatic escalation in the auto-enrolment system where a proportion of any increase in pay has to be allocated to a pension contribution until pension contributions reach a higher rate. Ideally a 12% contribution rate should be targeted over the next five years rather than the 8% rate currently in operation.

The paper also recommends a major shake up of the annuities market to increase choice when people hit retirement age:

1. The government should issue annuity type government bonds, which retirees could buy instead of the normal annuities. That would give clarity on the interest rates that were available in retirement. Insurance companies and other pension providers could then offer products that would provide income after the bonds had expired. In this way you could break out the life insurance and interest parts of the annuity.

2. The government should allow up to 50% of the minimum income requirement above the state pension element to come from a source other than annuities. That source would be in the form of an income drawdown from an equity or mixed asset fund. That investment would have to be a quoted and approved investment and we would limit the drawdown to the yield on that investment. That would give pension fund holders the chance to conserve their capital as well as receive an income.

James Barty, author of the report, said,

“People are not saving enough for their retirement. This is putting an intolerable burden on the state which needs to be addressed sooner rather than later. “With an ageing population, putting money aside for later life should be seen in the same context as National Insurance contributions, taxes and even education – an obligation that falls on everyone in society.

“’Help to Save’ will prevent the state from having to pick up the tab for people who haven’t put aside enough money for later life.”

Dr Ros Altmann, an independent pensions expert and former government advisor, said:

“Solving the pensions crisis is essential. Action must be taken to avoid increasing numbers of older people living on inadequate incomes. Ensuring that people contribute more than the auto-enrolment minimum is certainly important to deliver better pensions and using pay rises to fund higher contribution levels is the best approach.”

Alan Brown, Senior Adviser, Schroders Investment Management commented:

“Underfunded pensions are a ticking time bomb and ignoring the problem will not make it go away. We must fund our pensions in a sustainable way which is fair both to the current generation of workers and to those who are to follow.”

To read the report in full please click here

|