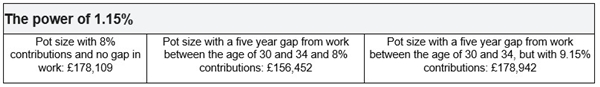

While celebrating how far we’ve come, it's vital to also recognise the ongoing need to tackle lasting gender barriers. And so, with IWD’s 115th anniversary in mind, we looked at the difference a small increase in pension contributions could make in retirement, choosing 1.15% in honour of the landmark date:

This modelling shows us that a relatively small behaviour change early in a woman’s career can make a significant difference to retirement income. An extra 1.15% invested into a pension from the age of 22, pushing contributions from 8 to 9.15%, would wipe out the deficit caused by taking a career break in their 30s to for instance have children. Simple calculations like this show women the power of the possible. Education can do as much as policy reform to support in closing the gender pensions gap.

Jackie Leiper, Managing Director at Scottish Widows commented: “Significant progress has been made towards gender equality in the last 115 years, but International Women’s Day still serves as a reminder of the remaining work that needs to take place. Women typically experience a shortfall in their retirement income due to taking longer career breaks, notably for caring responsibilities. This not only affects their pension contributions, it also holds them back financially. But the problem isn’t insurmountable. There are things women can do throughout their career to prepare themselves well for the future. For example, from our modelling, it’s clear how beneficial adding as little as 1.15% to pension contributions can be. The key thing is to start that preparation early. Improved education on how to support women to engage in their pension early is a must. Combined with policy changes this will play a crucial role in helping all women take action early when it comes to their pension savings and start thinking of themselves as investors.”

In line with this year's theme for International Women’s Day, Jackie Leiper, Managing Director at Scottish Widows, has shared five tips to help women #AccelerateAction, improve their savings and get better prepared for the future:

1. Follow through: Try not to pause pension contributions

While the cost-of-living crisis might make pausing pension contributions seem tempting, this is likely to be a mistake in the long term. Making decisions about how to manage any shortfall in funds is a difficult one, but pausing contributions means you'll miss out on valuable employer contributions and the power of compound interest.

2. Plan ahead: Factor in life events

Maternity leave and childcare are significant factors impacting women's pensions.

It’s always worth checking if your employer will continue pension contributions for you during maternity leave. It's not mandatory, so find out their policy before you start preparing. Aiming for small, consistent contributions throughout your career can help plug any career break gap in contributions. Even a 1.15% extra contribution in your twenties can significantly offset the impact of career breaks in your thirties. It’s important, where possible, to maintain your earnings and pension contributions as much as you can. Another big life event where pensions are understandably overlooked is during divorce settlements. During this difficult time, it’s important to treat your pension as an asset equal to your house and understand you're entitled to 50% of your spouse's pension. If you are unsure, this is an area where professional advice can be invaluable.

3. Take action: Consider investing outside of your pension

Our research found that only 38% of women invest outside of pensions, compared to 55% of men3. Just like with pension contributions you benefit from the power of compound interest, so the sooner you invest, the better off you will be in the future. Even if you just start with £10, getting into the habit of investing as early as possible will help you secure your financial future. Last year, Scottish Widows introduced the ability for workplace pension customers to access ready-made investments via its app, in an effort to make investing easier for savers.

4. Be alert: Find out what state your pension(s) is in

Knowing what you have saved to date, particularly if you have several pensions with different employers, is key. Employers will provide information about your workplace pension scheme, including contribution options, investment opportunities and strategies that are being used. The MoneyHelper website, a government-supported resource, can also be very useful. It offers a wealth of information on pensions, including state retirement forecasts checks, best-buy comparisons, and pension calculators.

5. Engage: Consolidate your pensions

Tracking down all your pension pots will help you have better control over your savings, understand their worth and assess if you’re on track with affording your plans for retirement. However, if consolidating, make sure you don't lose valuable guarantees attached to older pension schemes, such as guaranteed growth rates or annuity rates: where those guarantees exist it might be worth retaining that pot. Many modern pension providers offer consolidation services, making the process simple.

|