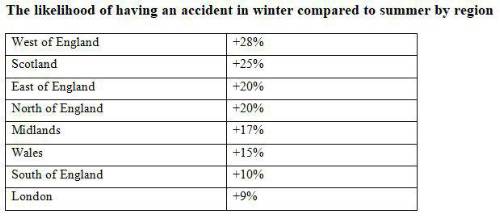

Across the UK, insurethebox data shows drivers are 15% more likely to have an accident during winter than in the summer. The highest difference is in the West of England, where the chance of an accident increases by 28%. London sees the lowest change with accidents only 9% more likely in the capital during winter months.

Gary Stewart, Service Manager at insurethebox believes the greater increase in accident risk in more rural areas of the country can be attributed to a number of factors: “Country roads are typically the most risky when the weather turns cold. Potholes can be neglected for months and sometimes years and the lack of on-street lighting makes visibility much poorer.

“That’s why we urge drivers of all ages and experience levels to make sure their vehicle is winter-ready. At least then they will be as well prepared as possible should they face difficult conditions. Check tyre tread, keep the windscreen wash topped up and, of course, plan ahead before making journeys in wintry conditions.”

The raised risk of an incident in the winter is further highlighted by the number of emergency calls made from Accident Alerts that insurethebox receives from its customers. The latest data shows a 27% rise in emergency calls in the winter compared to the summer.

Accident Alert is integral to an insurethebox policy. If a significant G-Force impact is registered, insurethebox examines the time of day, whether the vehicle is still moving, and the type of road the vehicle is on. The team will then attempt to contact the customer to check they are alright. If insurethebox is unable to reach the policyholder, its team will review and make a decision on whether to call the emergency services with the location of the vehicle. The alert is reliant on multiple factors, therefore insurethebox always advises customers to call emergency services if possible.

With January done for another year, motorists might be tempted to relax on their next journey. However, insurethebox data shows that it’s not just the first month of the year where the risks are greatest. The eighth riskiest day to drive is 28th February, while 1st March is the highest placed day outside of January, sitting 4th in the overall rankings[iii].

|