Long-term investment returns show value of keeping calm and reinvesting dividends

On a Friday twenty-five years ago today, the UK was hit by hurricane-force winds that uprooted trees and damaged buildings across eastern England. But for investors, worse was still to come. On the following Monday, stockmarkets crashed around the world.

‘Black Monday' saw share values plummet in the US, UK and Asia, and the losses continued to mount in the succeeding days. To many at the time, Black Monday may have seemed almost apocalyptic, but today it looks like no more than a blip when viewed through the lens of a quarter of a century, as data gathered by J.P Morgan Asset Management illustrates.

Timing isn't everything

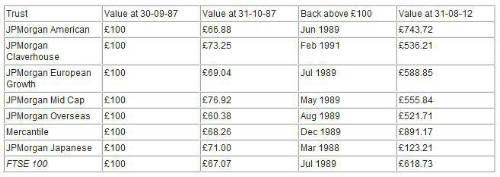

No investor wants to feel they have put their money to work just before a market fall significant enough to warrant its own adjective. But as the data below shows, even a big fall can translate into significant gains given a long enough time horizon. Taking the example of £100 invested in a selection of investment trusts managed by J.P. Morgan Asset Management on 30 September 1987, Black Monday and the additional declines of October 1987 wiped between 25% and 40% off the initial investment, but most were back above water within two years. And with the exception of Japan - which has had its own well documented problems since the 1980s - all have shown gains of at least 400% on a total return basis (with income reinvested) during the past 25 years.

Source: J.P. Morgan Asset Management/Morningstar, total returns, in sterling, 30 September 1987 to 31 August 2012.

David Barron, Head of Investment Trusts at J.P. Morgan Asset Management, said: "Although there was a feeling of panic around Black Monday, looking back on it now, it was a small blip in overall equity market performance. Markets have periods of excessive discounting of future earnings and periods of over-optimism, but as very long-term data sets like the Barclays Capital Equity Gilt study show, ultimately, there is a reversion to fair value. The overall trend is for equities to do better than cash or gilts for long-term investors."

What about other assets?

One of the most striking points about the above table is the importance of reinvested dividends in overall returns. Looking purely on an index level basis, the FTSE 100 went from 2373.8 points on 30 September 1987 to 5711.5 points on 31 August 2012 - not a bad return at 240.6%, but far removed from the 518.7% return of the FTSE 100 with dividends reinvested. The Mercantile investment trust, which targets an attractive income yield from a portfolio of smaller and mid-cap companies, saw a total return of nearly 800% over the period.

So what of some other popular, but non income-producing assets? The Halifax House Price Index shows the average house price rose from £47,248 in September 1987 to £160,256 in August 2012 - a rise of nearly 400%. The price of gold saw a similar increase, from $454.90 on 30 September 1987 to $1,692.01 on 31 August 2012, a rise of 372%. (House price figures from Lloyds Banking Group; gold price figures from Bloomberg).

All of these assets have also comfortably beaten inflation - as has cash, perhaps surprisingly, according to data from the Barclays Capital Equity Gilt Study, which shows an average annual real return of 1.1%.

Don't forget the tax angle

David Barron added: "It is worth remembering that 1987 was also the year that personal equity plans, or PEPs, were introduced, giving the opportunity to own shares and funds in a tax-favoured wrapper, so investors would have had the chance of largely tax-free income and gains since Black Monday, too.

"The important lesson for long-term equity investors is to stay invested through the ups and downs. It is very hard to time entry and exit points accurately, and the best days of returns often come soon after the worst days. Over the long term, if you pick good funds and managers, diversify your asset allocation and reinvest your dividends, you are unlikely to go wrong."

|