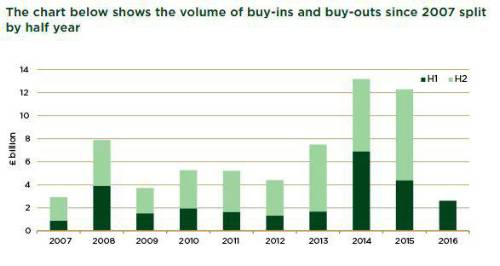

LCP Partner, Charlie Finch said, “Last year schemes brought forward transactions ahead of the introduction of Solvency II in 2016. While this meant a record £5.4bn of volumes in Q4 2015, it also accounts for reduced volumes for H1 2016 compared to 2014 and 2015. However, the underlying picture is one of a high-level of activity and strong price competition.”

LCP’s analysis of insurer data for H1 2016 reveals:

-

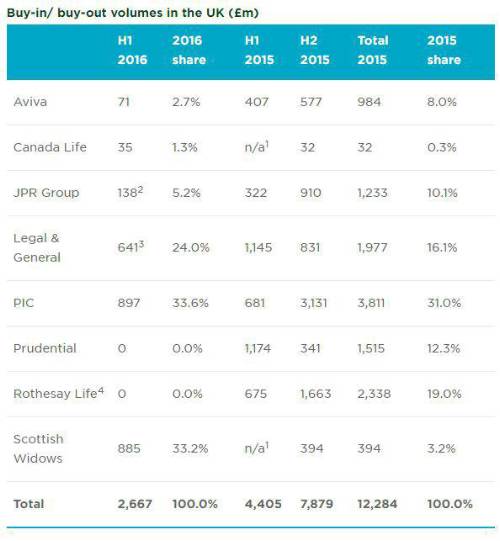

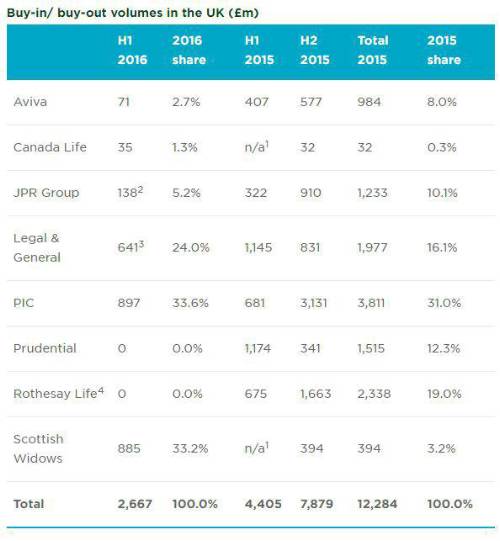

The first half of 2016 was dominated by established providers, Legal & General and Pension Insurance Corporation (PIC), and a new provider, Scottish Widows, which joined the market late last year. Together these three insurers accounted for £2.4bn of the £2.6bn of business. L&G wrote a further £750m buy-in in July with the ICI Pension Fund pulling them ahead with c£1.4bn for the year to date.

-

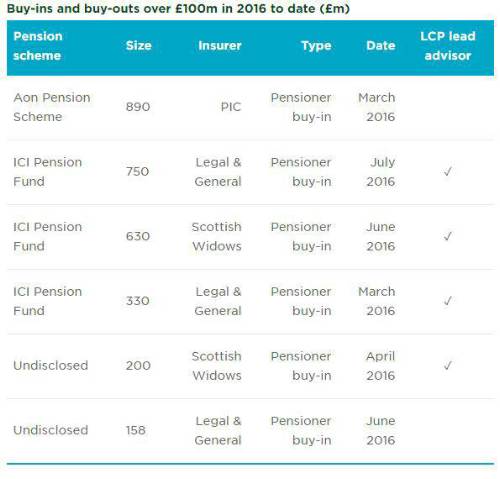

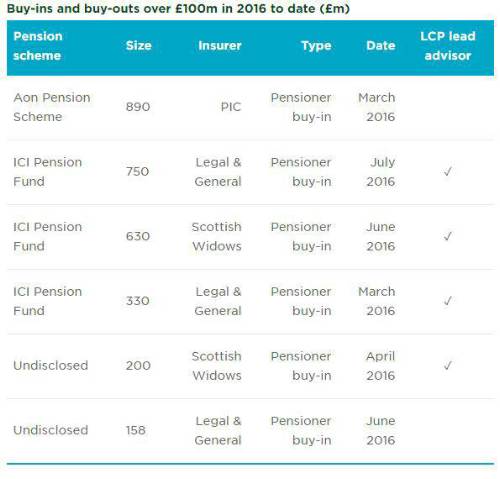

There have not yet been any bumper £1bn plus buy-in or buy-out transactions in 2016 so far. However, there continued to be a steady flow of mid-sized deals with five transactions between £100m and £1,000m in the first half of 2016 compared to six in H1 2014 and seven in H1 2015.

-

Both L&G and Rothesay Life wrote a material “back-book” transaction with insurer Aegon in H1 2016 to acquire Aegon’s legacy UK annuity book (£6bn was acquired by Rothesay Life and £3bn by Legal & General).

-

Across buy-ins, buy-outs and back-book transactions, nearly £12bn of insurer capacity has been deployed so far in 2016. Last year LCP predicted that insurer capacity will increase to over £15bn for 2016.

-

The first half of the year saw some changes to the insurers participating in the market. Just Retirement and Partnership merged on 4 April 2016 and Prudential confirmed in their half year results on 10 August 2016 that they have withdrawn from the bulk annuity market citing the capital requirements under Solvency II. This means that currently there are seven active providers in the buy-in and buy-out market.

A full summary of the data is set out at the end of this press release.

Commenting on the activity so far this year, Charlie Finch, partner at LCP said: “With Prudential as the notable exception, the new capital reserving regime under Solvency II has not dampened enthusiasm for pensioner buy-ins with six or seven insurers actively competing on recent transactions. Combined with favourable market conditions this is leading to pricing materially below a gilts-based valuation reserve for some schemes.”

“Full buy-outs have been limited to smaller schemes so far in 2016 as insurers got to grips with how the new capital rules impact deferred pensioner pricing. Schemes have also had to battle with falling yields in the wake of the EU referendum vote. Whilst the fallout from the vote opened up attractive buy-in pricing opportunities for schemes that can move quickly – demonstrated by the £10m that the ICI Pension Fund saved on their buy-in last month – it has reduced affordability for full buy-out for all but the best hedged schemes.”

“Insurers are reporting a strong pipeline of cases and we expect buy-in and buy-out volumes for the second half of the year to materially exceed those in the first half.”

LCP has been lead adviser on four out of the six buy-in and buy-out transactions over £100m announced so far this year.

Source: Insurance company data. Transactions by UK pension plans only.

1 Canada Life and Scottish Widows entered the buy-in and buy-out market in the second half of 2015 so have no business in H1 2015.

2 Just Retirement and Partnership merged on 4 April 2016 to form the JRP Group. The full H1 results for JRP are due to be released on 12 September 2016. Therefore the H1 2016 data for JRP does not include Q2 2016 data, except for a £95m buy-in with Galliford Try which was announced in June 2016.

3 Legal & General’s H1 2016 data excludes the £3bn transfer of annuities from Aegon to L&G in May 2016 and the $65m bulk annuity in the US market.

4 Rothesay Life’s data covers all publicly announced transactions with UK pension plans. The data excludes the £6bn transfer of annuities from Aegon to Rothesay Life in April 2016 and the £1.3bn transfer of annuities from Zurich to Rothesay Life in 2015.

Source: Insurance company data for H1 2016 and public announcements

Further details of previous years can be found in LCP’s report “Buy-ins, buy-outs and longevity swaps 2015” available here |