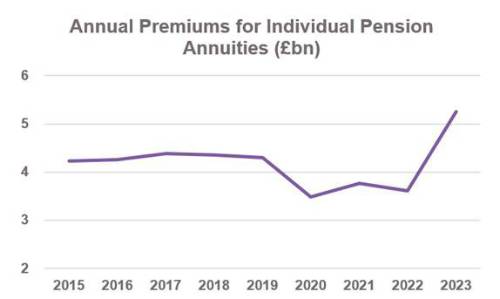

Annuity sales soared in 2023 with a total sales value of £5.2 billion, a 46% increase on 2022. This is the highest annual value since 2014 when pension freedoms were announced, which granted retirees more flexibility over how to access their retirement savings.

This record year included a bumper fourth quarter which saw £1.5 billion in sales, off the back of a strong third quarter when sales totalled £1.4 billion.

The number of annuity contracts sold also increased in 2023, to 72,200 (+34% on 2022). This is the largest number recorded since 75,000 were sold in 2016, reflecting strong consumer desire to lock in a guaranteed income for their later years.

Level-only annuities, which pay the same income every year but can be vulnerable to inflation, remained the more popular version of the product, at 82% of the total number sold. This type of annuity has a higher starting income than an escalating annuity - which provides an income that increases every year. The proportion of escalating annuities sold increased by 2 percentage points vs 2022, making up the remaining 18% of total sales.

With six providers now offering annuities to new customers, 2023 also saw 64% of annuity buyers shop around – taking an annuity from a different provider to the one they held their pension savings with.1

However, only 29% of customers who bought an annuity did so with the help of professional advice. The?FCA’s Financial Lives 2022 survey 2 shows that consumers struggle to make crucial decisions about their savings, investments and pensions without regulated financial advice.3

Recent research carried out on behalf of the ABI by Thinks Insight and Strategy’s Behavioural Team suggests that there could be a compromise when it comes to advice. The research suggests that when professional guidance is ‘personalised’ to an individual’s circumstances, it can significantly impact the individuals decision making, leading to a better financial outcome.

Meanwhile, the Government and FCA’s continued work to close the advice gap as part of their Advice Guidance Boundary Review provides the opportunity to take a step in the right direction in closing the advice gap.

Rob Yuille, Head of Long-Term Savings Policy, Association of British Insurers, said: Securing a guaranteed income for life remains an important part of the mix of options for people to consider at and during retirement, and it’s great to see more people taking advantage of the protection they have to offer. It is also encouraging to see more people exploring the market to secure a higher income.

“However, we’d like to see more people taking advantage of professional advice and new forms of targeted support for consumers to ensure they can enjoy the best possible retirement.”

Providing vital protection and peace of mind to Defined Benefit pension scheme members and their employers, the bulk annuity market also continued to thrive with sales reaching £22 billion in the final quarter of 2023, taking the yearly total to £49.3 billion.

|