-

Just 7% of over-55s rate leaving an inheritance as their top financial priority

-

Nearly a quarter of pre-retirees do not expect to leave an inheritance

-

Property wealth increasingly central to people’s inheritance plans

A quarter of over-75s (25%) – and more than a fifth of over-55s in total (21%) – have given a cash loan to family members instead of leaving an inheritance, according to Aviva’s latest Real Retirement Report. The findings also show nearly one in ten over-55s regularly give money to family to avoid inheritance tax (8%), while a further 20% would do the same.

The spring edition of the report examines the financial pressures faced by the UK’s three ages of retirement – 55-64s (pre-retirees), 65-74s (the retiring) and over-75s (the long-term retired) – and focuses specifically on attitudes to inheritance. It shows just 7% of over-55s rate this as their top financial priority in retirement, and while this predictably increases with age, just 18% say the same by the age of 85.

Inheritance loses traction among pre-retirees:

Building up an inheritance pot in May 2013 comes a distant third as a financial priority for the over-55s behind meeting living costs (77%) and providing more immediate support to family (17%). It is only after the age of 65 that it becomes their second priority after managing the cost of living (69% vs. 19%) and ahead of family support (12%).

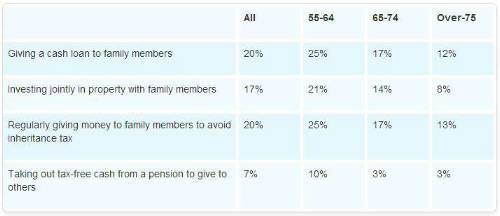

Instead of leaving an inheritance, the over-55s are open to various alternatives to pass on any available wealth. There is a clear generation gap in their attitudes separating the pre-retirees – who are most willing to consider other approaches – from the long-term retired who are more traditionally minded [see Table 1].

Table 1: Actions the over-55s would take instead of leaving an inheritance:

To increase their available wealth, shopping around for the cheapest deals – for example, during their weekly food shop – is the most popular step the over-55s would take (18%). More than one in ten would downsize or move to a cheaper home (12%) and a similar number would work part-time in retirement (11%) or take fewer holidays abroad (10%).

However the over-55s are also motivated to safeguard their own standard of living during retirement. Less than one in ten would sacrifice home improvements to benefit the younger generation (8%), fewer still would dine out less or avoid takeaway meals (7%) and even fewer would swap a car for a cheaper model (4%).

Economy clouds inheritance plans:

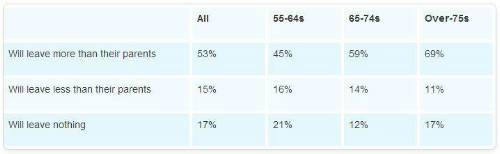

Despite the attitude shift among those approaching retirement, more than half of over-55s still expect to leave more inheritance than their parents (53%), with 37% planning to leave significantly more.

However this confidence is highest among the over-75s and falls away among the 55-64s and 65-74s, suggesting the economic situation has undermined people’s financial security on the lead-up to retirement.

Despite more than half of 55-64s still receiving a wage or other earned income in May 2013 (58% compared with 46% in May 2010) nearly one in four of this group expect to leave no inheritance behind (21%).

Table 2: How the over-55s’ inheritance plans compare to their parents

Property assets play an increasingly important role:

With savings squeezed, property is becoming a bigger feature of people’s inheritance plans. Nearly two thirds of over-55s plan to leave behind the family home (65%) yet only a third received this from their parents (34%). More than twice as many expect to leave other property or land (8%) as received this from their parents (3%).

However, up to 16% of over-55s have seen their later life plans impacted by the housing market crash which has left them with less property wealth either to leave as an inheritance (12%) or release equity in order to help their finances in retirement (4%).

More than one in four over-55s believe becoming a parent is the best time to begin planning to leave an inheritance (26%). However just 17% take action at this stage – no doubt influenced by the costs of raising a family. Instead, nearly one in four wait until the final years of work or the first years of retirement before planning their inheritance (23%).

Clive Bolton, managing director of Aviva’s At Retirement business, comments:

“It is not just the older generation who have seen their financial realities change, but also younger family members who often need support to access the property ladder or raise children of their own. For some over-55s the desire to leave an inheritance plays second fiddle to more urgent financial proprieties, and even those who are financially secure are often tempted to share their wealth during retirement rather than wait to leave an inheritance.

“Many over-55s who bought their homes much earlier in life have benefited from growing house prices in the decades since and understandably hope their family will share the proceeds as part of their inheritance. Anyone who needs to call on their property wealth at an earlier point – either to support themselves or family members – can aim to downsize or take out inheritance protection with equity release plans to safeguard a fixed amount for their loved ones’ future use.”

Download Aviva Real Retirement Report Spring 2013 PDF (4.3 MB)

Methodology:

The Real Retirement Report was designed and produced by Wriglesworth Research. As part of this more than 16,686 UK consumers aged over 55 were interviewed between February 2010 and May 2013. This data was used to form the basis of the Aviva Real Retirement Report. Wherever possible, the same data parameters have been used for analysis but some additions or changes have been made as other tracking topics become apparent.

|