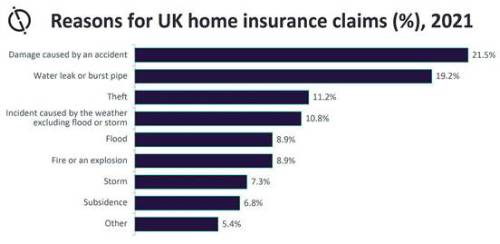

GlobalData’s 2021 UK Insurance Consumer Survey shows that weather incidents, including floods and storms, now account for 27% of all home insurance claims. Of these weather-related incidents, storms only account for 7.3% of the 27%.

Beatriz Benito, Lead Insurance Analyst at GlobalData, comments: “The ever-increasing nature of severe weather events, not only in the UK but around the world, highlights the importance of tackling climate change. This will be particularly challenging to insurers, who will face the prospects of very expensive claims. Indeed, the scale and regularity of such events can lead to extortionately high claim payouts.”

While it is still too early to assess the impact of storms Eunice and Franklin, the Association of British Insurers (ABI) estimates that previous similar storms, such as Ciara and Dennis, saw insurers having to pay out over £360 million. Insurers must brace themselves for a situation that is unlikely to change in the near future. The ABI also found that domestic property claims for weather-related incidents had more than doubled in 2020 compared to 2019, totaling £459 million in claims and accounting for 20.7% of the gross claims total.

Benito adds: “Home and commercial property insurers are not the only ones who will bear the brunt of these problematic weather incidents. Motor insurers, too, will face such consequences; weather events may lead to falling branches and trees as well as flying debris, which may damage vehicles parked on roads. Worse, severe weather events may claim lives.”

With the prospect of weather events becoming even more problematic, insurers are looking at ways to mitigate costs and prevent damage. Leading insurers and reinsurers utilize big data and analyze data points such as wind speeds, water temperatures, and air temperatures to predict the likelihood of events. Predictive risk models can be derived from these data, helping insurers predict severe weather risks such as flooding and fires. This in turn helps insurers improve their risk selection, which leads to better insurance and reinsurance pricing. However, as these technologies become more widespread and improve, and the data becomes more robust, large areas of land may become uninsurable.

|