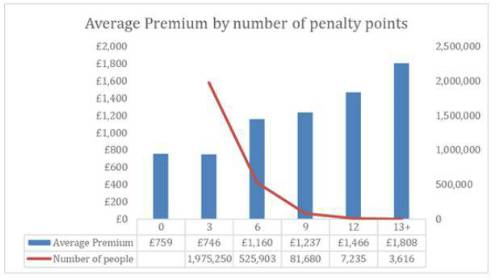

The research shows that premiums remain broadly flat if a driver goes from zero to three points on their licence, with the average premium currently standing at nearly £750. However, if you jump from three to six points, the cost of insurance rockets by more than £400 to an average of £1,159. This means that, on average, having three points added to your licence costs £209. The cost of insurance gets progressively higher the more points are added to your licence, reaching an average premium of £1,466 for those with 12 points.

While drivers may also receive fines for reckless driving, many may not consider the longer-term impact that being penalised for poor driving can have on insurance. Penalty points can be added to your licence for a number of reasons and, if you have 12 points, you are automatically disqualified from driving for 6 months.

An analysis of DVLA’s licencing statistics finds that over 70% of penalty points imposed on licences were given to men. Nearly 2 million male drivers (1,905,000) have points on their licences compared to 786,000 women. While there are nearly 2 million people with three points on their licence, the number significantly drops as the number of points increases. Over 500,000 people have six points on their licence while only 80,000 have 9 points and 7,000 have 12 points. With over 2.6 million British driving licences with penalty points on them, motorists are paying more than £230 million in increased insurance premiums.

comparethemarket.com found that an overwhelming majority of penalty points come from speeding violations – accounting for 85% of respondents with points on their licence. Running a stop sign or traffic light and using a mobile phone while driving was the next most common infractions accounting for 7% and 5% of respondents.

However, despite over 2.6 million people having points on their licence, the points system seems to work well. Nearly 75% of drivers with points on their licence said that receiving points made them change their driving habits to be safer on the road.

Dan Hutson, Head of Motor Insurance, comparethemarket.com, said: “The cost of a motor insurance policy depends on the risk profile of the driver. If you are deemed more likely to be in an accident, the insurer is more likely to have to pay out and therefore your premium will be higher.

“One of the many ways that insurers analyse risk is the number of penalty points that you have on your licence and these statistics put in to focus the serious impact that irresponsible driving can have on a policy. Beyond the obvious safety concerns, drivers should be incentivised by these numbers to take care when on the road or risk being charged a huge amount for cover.

“The fact that men have received nearly 70% of penalty points goes someway to explaining why the cost of insurance is so much higher for men than women, despite the EU regulations.

“It comes as no surprise that speeding is by far and away the most common reason for points being added to licences. However, what is encouraging is that the points system works. While the fact that 2.8 million people have points on their licence implies that it does not deter people from breaking the law, 73% of people have said they drive safer having received the punishment.”

|