Over the past three years the Covid-19 pandemic, inflation and rapidly rising interest rates have taken their toll on households and had a significant impact on finances, with many people understandably having to focus on making ends meet in the short term rather than the future. While these unprecedented pressures have made saving a huge challenge for many people, analysis from Standard Life, part of Phoenix Group shows the big impact even a short contribution break can have on overall retirement pots.

Opting out of pension contributions mean savers miss out on thousands in future

The relatively small number of people who were auto-enrolled and chose to opt out of their workplace pensions during the Covid pandemic will be at or reaching the three year point where they will begin to be automatically re-enrolled in their scheme. However, during the period of opting out, they may have missed out on significant pension savings.

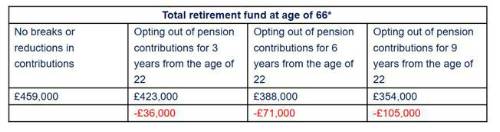

For example, someone that began working with a salary of £25,000 per year in 2020 and paid the standard monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could amass a total retirement fund of £459,000 at the age of 66, not adjusted for inflation. However, opting out of pension contributions for three years at the start of their career, could result in a total pot of £423,000 – £36,000 less than if they had not stopped paying in. Opting out of auto-enrolment and their workplace pension for a longer period could have an even bigger impact:

*if beginning working with a salary of £25,000 per year and paying 3% employer and 5% employee monthly contributions into a workplace pension at the age of 22, assuming 5% investment growth, 3.50% salary growth and a 0.75% investment charge

Gail Izat, Managing Director for Workplace at Standard Life, said: “Households have had a great deal to contend with over the past three years, with many having to cut back on spending and saving as a result. While cutting back on long-term saving might seem like the least harmful of a bunch of bad options, particularly earlier in life, it could result in people missing out on tens of thousands of pounds in retirement.

If you’ve opted out in recent years, when circumstances allow remember your pension. Your future self may well thank you.”

|