-

Job satisfaction and social life most common reasons for age choice

-

London most youthful-feeling region

Most people have a particular time in their life that they look back on fondly. New research* from AA Life Insurance reveals that the UK’s favourite age is 34 – but not for the reasons you might expect.

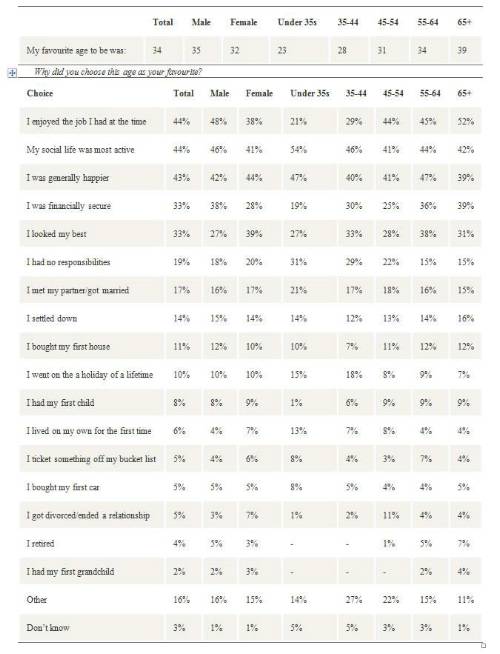

It’s at their ‘favourite age’ that respondents were most likely to be satisfied with their job and social life, both cited by 44% of respondents in a poll by Populus for AA Life Insurance. Other reasons for favourite age choice include being generally happier (43%), while looking their best and being financially secure came joint fourth (both 33%).

But there were gender differences: 48% of men said that job satisfaction was the defining feature of their favourite age, that being so for 38% of women, followed by ‘social life’ (46%, 41% for women). For women, the top characteristic was being ‘generally happier’ (44%, 42% for men). ‘I looked at my best’ was chosen by two-fifths (39%) of women, while only a quarter of men (27%) said the same.

Only 16% of men and 17% of women chose the age they met their partner and just 8% of men and 9% of women said the age they had their first child was their favourite.

The study into age preferences revealed that overall; the thirties are the most popular decade. The oldest favourite age was chosen by over 65s who opted for 39. Unsurprisingly, the youngest favourite age was chosen by under 35s who preferred 23.

Mark Huggins, Managing Director of AA Life Insurance said: “It’s not uncommon for people to dislike getting older so we might expect favourite ages to be on the younger side.

“Perhaps the awkward teen years, terrible haircuts and fashion faux pas’ of youth still haunt those who preferred their thirties.

“We’d assume people really enjoyed their thirties because they’ve achieved ‘life goals’ such as getting married and having children and are financially secure, too. Our research, however, shows this isn’t necessarily the case; career and social life were high on the happiness list, particularly for men.”

Londoners chose the youngest favourite age which was 30. People in the North East meanwhile chose the oldest at 37.

Other reasons for particular age choices include: having no responsibilities (19%), settling down (14%) and buying a house (11%). They’re followed by: going on the holiday of a lifetime (10%), living on their own for the first time (6%) and ending a relationship (5%).

Life insurance

At any age, taking out a life insurance policy is one thing it is worth doing to help financially protect your loved ones should you pass away. However, bear in mind that the younger you are when you take out a life insurance policy, the more cover you could get.

Mr Huggins comments: “As you might expect, our current figures show that you can get much more life insurance cover the younger you are. A 30 year-old could expect 25% more cover than somebody aged 35 and around 50% more than somebody who is 40 and pays the same premium.” **

“Recent reports show that the average household could only survive financially for 29 days*** once the main breadwinner’s income is lost.

“When you’re younger, planning for when you’re no longer around probably isn’t at the top of your to-do list, but having a life insurance policy in place could be invaluable should the worst happen.”

|