From April 2024 big changes happened in the tax system around treatment of beneficiary pensions, meaning the expression of wish form is now one of the most valuable forms in financial services, especially if death occurs pre age 75

New insight from Canada Life reveals nearly half (46%) of all UK adults with pension savings haven’t considered who should inherit their pension once they pass away. In April, as part of the changes introduced following the removal of the Lifetime Allowance, decisions made around beneficiary pensions have significant impacts on the way those pensions are taxed on receipt, especially if the death occurs pre age 75.

Canada Life is also stressing it is more important than ever to ensure the expression of wish is not only completed, but up-to-date. The research found over half of UK adults with pension savings haven’t completed an expression of wish form, while a further one in ten acknowledge either the form isn’t up-to-date or they simply don’t know.

The expression of wish form is held by the pension company, and in the event the customer dies, it will help distribute the pension quickly and efficiently taking into account the deceased’s views. The absence of an expression of wish form could result in delays to any beneficiaries receiving the pension, or worse still the potential for unintended beneficiaries receiving the pension.

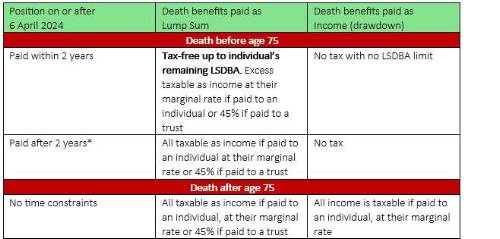

In addition, and following the removal of the Lifetime Allowance from April 2024, the way beneficiary pensions are taxed if the death occurs pre age 75 depends on whether the pension is received as a lump sum or as income. This will be determined by the expression of wish form and therefore any decisions may have significant tax consequences.

John Chew, pension, tax and estate planning specialist at Canada Life explains: “A decade of auto enrolment has encouraged over 11 million people to save for their retirements. While it may be difficult thinking about your own mortality, completing an expression of wish form and ensuring it remains up-to-date is a critical part of your financial legacy. Put simply, having an up-to-date form lodged with your pension company makes sure the company knows who you would like to benefit should you die. It provides a valuable piece of evidence when the trustees of the pension scheme try to establish the right beneficiaries to receive the money.

“From April, for those with higher value pensions, the abolition of the Lifetime Allowance brings further complexity around the tax treatment of beneficiary pensions. The relationship of the beneficiary to the deceased, and whether they choose a lump sum or drawdown could be the difference between paying tax or not, especially if the death occurs pre age 75.

“While it may seem like a small admin task to put off for another day, completing an expression of wish form should only take a few minutes. Ask your pension provider or HR department for a copy, and remember if your circumstances change, you should always review and submit a new form if required.”

Case Study - Sue and John, and grandson Sam

Sue has been nominated as the beneficiary of John’s pension, who passed away age 69. Sue can choose to either take the whole pension as a lump sum, or as drawdown. As the value of the inherited pension is over the lump sum and death benefit allowance (£1,073,100) certain tests will apply and depending on whether the scheme offers dependent drawdown or a lump sum could determine whether Sue pays income tax (on the lump sum above the death benefit allowance at her marginal rate) or no tax (on drawdown). All of this depends on whether Sue elects to take any benefits within two years of John’s passing.

Sue could decide she doesn’t need the pension and opt to pass this down to Sam, using the expression of wish form. However, if Sam isn’t nominated as a beneficiary (and he isn’t a dependent) his only choice is a lump sum and will therefore pay income tax on the amount. If Sam was named as a beneficiary of the pension, he would have had the choice of lump sum or drawdown where he may not have to pay income tax.

*two years starting on the date on which the scheme administrator first knew, or could be reasonably expected to know, of the members death. Source: Canada Life March 2024

|