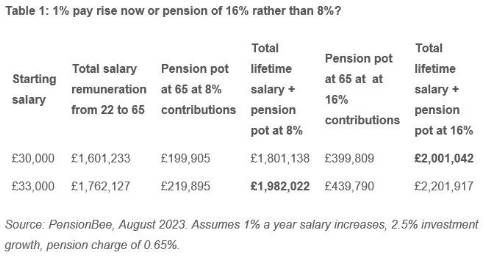

In fact a good pension, for example, one that pays 16% of your salary rather than 8%, can be better for your finances throughout your lifetime than a 1% higher starting salary.

Yet pensions are an often overlooked part of the overall employment package. This is often down to a lack of information from employers about the pension scheme being provided as part of the application process. But with pensions making such a huge difference to retirement outcomes, they should arguably take greater prominence in the information given by employers and considered by applicants, as well as any other financial benefits on offer, such as Sharesave, share options, salary sacrifice car schemes, private health insurance, income protection insurance or shopping discounts.

These days, through Auto-Enrolment, everybody who is over age 22 and earning over £10,000 gets a pension (although these minimums are set to come down), so just having one through work is the least you should expect.

The minimum contribution to a workplace pension is 8%, with 5% of this, including tax relief, coming from the employee. While many employers stick with the minimum contribution, some offer far more, with the most generous in the private sector offering double matching of contributions, where if the employee puts in more, then up to a maximum, the employer will ‘double match’ these additional contributions, sometimes taking the total amount to more than 20%.

Remember that even without employer matching, you can increase your own contributions to your pension and benefit from tax relief on those contributions.”

• What are the employer contributions?

Defined contribution schemes offer a minimum total contribution, including the employee’s, of 8% under Auto-Enrolment, but can be far higher. The amount employers pay in can vary from 3% to well into double figures, which can make thousands of pounds difference to you when you retire. ‘Double matching’, when you increase what you put in and the employer doubles up on your contributions, up to a maximum, is a very effective way of ramping up the amount going into your pension.

If your employer contributions, plus your own, take you to over 10%, that’s more than average. If it’s more like 15%, you are in an above average pension. There is pressure on the Government to increase the minimum to 12%, to improve retirement outcomes.

But in an ideal world, 15% would be better. Paying in 15% of a salary that starts at £30,000 at age 22 would give you a pot size of £374,821 at age 65 - which is likely to be enough for a moderate to comfortable living standard in retirement, according to the Pensions and Lifetime Savings Association standards.

• Is the pension defined contribution or defined benefit?

Defined benefit schemes are where your employer agrees to pay you a certain income in retirement, which could be based on your earnings level throughout your time at that company or what you earn when you leave. While they usually require some type of contribution from your salary, you do not take responsibility for your pot, your employer does - and the contributions added by the employer are usually pretty high.

These schemes tend to be more generous in terms of what you get out at the end as income than defined contribution pensions. Defined benefit schemes are more common in the public sector and large private sector organisations, although they are becoming more rare, as they can be difficult for employers to fund.

Defined contribution pensions are now far more common in the private sector and the chances are this is what your new employer will offer. This is where your contributions and your employer’s are invested in a pension fund and by the time you finish work, the hope is this will have grown into a decent-sized pot for you to be able to retire.

• Is the pension salary sacrifice, net pay or relief at source?

‘Net pay’ pension contributions are where the full amount of your contribution is taken before tax is deducted, so that you end up with a lower tax bill on your earnings.

‘Relief at source’ contributions are where your contributions are taken from your pay after your salary is taxed - you then get 20% basic rate tax relief added by your provider to your pension contribution. If you are a higher rate taxpayer, you claim the extra relief you are owed via your tax return.

Low earners can sometimes be at a disadvantage in net pay schemes - relief at source contributors get the tax relief added to their pension, even if they don’t pay tax. The Government has announced plans to correct this anomaly for low earners in net pay schemes by 2025.

Salary sacrifice is a bit like net pay, but is an agreement to give up some of your salary, which is then paid into your pension instead by your employer. So the employer makes the contribution rather than the employee. This arrangement also results in National Insurance savings.

• Are there any other long-term savings benefits?

It’s not all about the pension. Some employers offer other long-term saving schemes, such as share incentive plans, save as you earn schemes and share option plans. These usually mean that if your company does well, your rewards increase. While these are not substitutes for pensions, they often come with tax advantages and are worth considering when deciding on the overall attractiveness of your package.

• How will my money be invested and are the investments sustainable?

Research from Make My Money Matter found that UK pension schemes invest approximately £112 billion in fossil fuels annually. If the environmental and social impact of your money is important to you, then you might want to ask whether the employers’ pension scheme is invested sustainably, or has a sustainable plan option available.

|