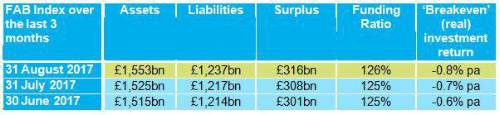

The PLSA also claims that, despite employers spending £120 billion over the last 10 years in special contributions, deficits have remained at over £400 billion. In contrast, First Actuarial’s Best Estimate (FAB) Index improved again in August, with a month-end surplus of £316bn and a funding ratio of 126% across the 6,000 UK defined benefit schemes.

First Actuarial Partner Rob Hammond said: It is dangerously misleading of the PLSA to claim that there is only a 50:50 chance that some three million members will receive full benefits. And quoting multi-billion pound deficits, without proper context, risks unduly harming confidence in pensions for employers and members.

“Our FAB Index suggests there is a 50:50 chance that the 6,000 UK defined benefit pension schemes have a surplus of over £300 billion. And this is before allowing for scheduled payments of the order of a further £100 billion in place under existing recovery plans.

“So, opinions clearly vary. The problem with the PLSA claim is that it has been presented as fact, when it is simply an opinion – an opinion which could have grave consequences if misinterpreted.”

Hammond added:

“This careless scaremongering plays into the hands of pension scammers who will use it to dupe people away from perfectly sound DB pension schemes.”

The technical bit…

Over the month to 31 August 2017, the FAB Index improved, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £308bn to £316bn.

On the other hand, the deficit on the PPF 7800 index deteriorated over August from £180.1bn to £220.4bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best estimate basis – the so called ‘breakeven’ (real) investment return – has remained at around minus 0.8% pa. That means the schemes need an overall actual (nominal) return of 2.8% pa for the assets to meet the liabilities.

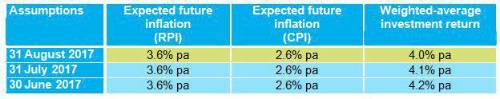

The assumptions underlying the FAB Index are shown below:

|