-

Nearly a quarter of UK workers say their savings and retirement plans have been impacted by historic low 0.5% base rate

-

Two thirds of UK employees now expect to work beyond retirement age

-

44% of employees likely to work beyond 65 blame insufficient pension savings

-

Spotlight on pensions in recent years has increased consumer awareness of low contributions

Overall, 23% of employees have seen their retirement plans affected by low savings rates since the 0.5% Bank of England base rate was introduced seven years ago. This includes 8% who did not want to work beyond 65 but have now resigned themselves to doing so, and 16%[2] who had contemplated working past 65 but now believe low interest rates will probably push them to do so.

Retiring at 65 out of reach for six in ten UK workers

Overall, two thirds (67%) of UK employees expect to work beyond the traditional retirement age of 65. This continues to climb as the reality of a rising State Pensions Age and the abolition of the default retirement age in 2012 becomes clear (2015 – 61%; 2012 – 35%)[3].

Younger generations fare particularly badly: 85% of those aged 21-30 believe they will have to work beyond the age of 65. This is in stark contrast to those soon to retire, with just 58% of 61-65 year-olds saying they are likely to work beyond the traditional retirement age.

Poor pension savings lead many to work later in life

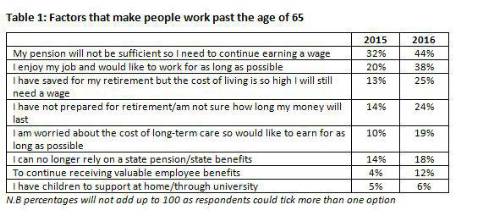

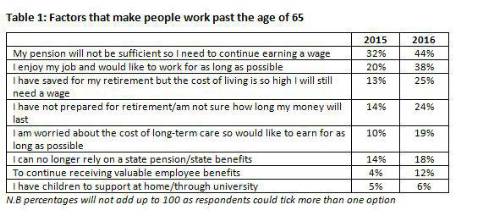

Financial pressures are the main factor people cite as the reason they’ll have to work beyond the traditional retirement age. More than two in five (44%) employees say their pension pot is not sufficient to retire at 65, up from 32% who said the same in 2015.

The proportion who believe they will have to carry on working because they have not prepared enough has also increased, almost doubling year-on-year (14% in 2015 vs 24% in 2016). A lack of state support is also noted: the number who say they will not be able to rely on a state pension has increased from 14% in 2015 to 18% in 2016.

However almost two in five (38%) say job enjoyment is the reason they would like to work for as long as possible into retirement.

Pensions reforms announced in the 2014 Budget have increased awareness of planning for retirement. One in five (20%) employees found that since reviewing their savings after the freedoms were announced, they will have to work longer than they thought, highlighting the importance of planning ahead.

Paul Avis, Marketing Director of Canada Life Group, comments: “Seven years of rock bottom interest rates have had a lasting impact on a generation already plagued by insufficient pension contributions, with many forced to work past the age of 65. Recent reforms have spurred a long overdue national conversation about pension savings and a wave of employees have been confronted with the hard truth they are going to have to work beyond the traditional retirement age. The rising cost of buying a home and new savings options (such as the Lifetime ISA) could mean younger people prioritise saving for other long-term goals above pensions, leaving them in an even weaker position when they eventually approach traditional retirement age.

“An older workforce – be it out of choice or financial necessity – brings with it many benefits, such as a wider skillset and breadth of experience. Employers also need to factor in a larger number of health issues, with older workers more likely to experience illness or injury. Employee benefits should reflect this changing demographic. Flexible working or workplace wellbeing initiatives can prove invaluable to older workers, while critical illness cover and income protection ensure much needed support in the event of an accident or illness.”

|