New research from Phoenix Insights finds around half of UK workers are confident they’ll be able to their job by the time they are 70, although widespread under saving means many more may need to work beyond this to support living standards in retirement.

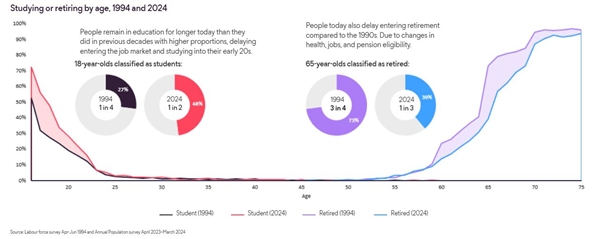

Retirement ages have been increasing in recent decades due to changes in health, jobs, and pension age eligibility. People are starting and leaving work later in life but are also living longer than the generations before them. Research from Phoenix Insights, Phoenix Group’s longevity think tank, finds around one in three 65 year olds are classified as retired, thirty years ago this was closer to three in four (73%).

Phoenix Insights (2024). Analysis of Labour Force Survey and Annual Population Survey.

However, confidence about working in later life is relatively low. The majority (78%) of workers think they will be able to do their job, or one like it, at the age of 60, but this drops to half (49%) by the age of 70. For those who aren’t confident about remaining in work, the main concerns are around physical and mental health, motivation and a lack of support for older workers. A fifth (21%) of this group say they have worries about age discrimination in the workplace.

Working later life and plugging the savings gap

Phoenix Insights modelling suggests around 17 million UK adults are not on track for the retirement income they expect or need, with the saving crisis expect to reach boiling point for new retirees in the 2040s. Combining widespread under saving with an increasing state pension age could mean many more people will have to postpone their retirement to plug gaps in savings. Remaining in work, on reduced hours or full time, has the double effect of reducing the years to fund in retirement alongside the ability to continue to build up pension savings.

But not everyone is able to work into their late 60s and 70s. People in their early 60s make up a disproportionate proportion of the total workless population. If current trends continue, there could be an additional 770,000 people aged 60 to state pension age out of work by 2029, totalling 3 million.

This is hugely concerning as being out of work pre-state pension age is closely linked to rates of poverty. A quarter of all 60-65 year olds live in poverty, and people out of work aged 60-65 are twice as likely to be in poverty as those in work.

Patrick Thomson, Head of Research Analysis and Policy at Phoenix Insights and said: “How people enter, stay and leave work has transformed in recent decades. The average retirement age has increased by around five years since the 1990s and more people choose a gradual transition from work rather than having a ‘hard stop’. In the future, it’s possible average retirement ages will rise further alongside the state pension age rises as people want to continue working longer or feel they need to for financial reasons. In the next five years most defined contribution pension savers will enter retirement with savings below expectations or below an adequate level, and this will worsen to a peak in the early 2040s.

“While people may want to remain in work in their late 60s and 70s, it’s not always possible for some. Huge numbers drop out of work before state pension age and face barriers to re-entering. Without better support for this group to remain in work, an increasing state pension age and under saving creates a perfect storm for worsening later life poverty.”

Phoenix Insights recommendations to address over-50s economic inactivity

There are several reasons why the over-50s may struggle to remain in work, including challenges around long-term health conditions, caring responsibilities or disabilities. Phoenix Insights is calling for further action to address this, including:

1. Cross departmental strategy that recognises the unique challenges and opportunities for over-50s, covering policies around retention, recruitment, training, support and health.

2. Promotion of inclusive employment practices such as flexible work, paid carers leave, support for health and wellbeing across workplaces to nurture an age-friendly culture.

3. Active career management which addresses the employment advice gap and supports career moves, job changes and helps people back into work.

4. Focus on lifelong learning, skills and training to close the skills gap and increase adult participation in further education to ensure that we are reskilling all age groups.

5. Government and business should provide better retraining opportunities and age inclusive advertising of green jobs, and for employers to review pay and condition for these roles to attract experienced workers.

|