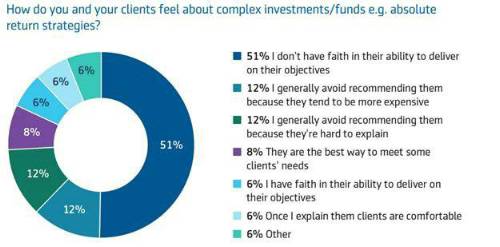

While half (51%) of advisers asked said that they were reluctant to recommend complex investment products due to confidence in their ability to deliver on their objectives, 12% of advisers noted the difficulty of explaining them to clients. An equally important consideration was cost with over one in ten (12%) saying that they’re too expensive.

Around a quarter of advisers made a positive case for the products on suitability grounds (8%), their ability to deliver on their objectives (6%) or due to their ability to explain the products (6%) among other reasons.

The introduction of both PROD and MIFID II just over three years ago has likely impacted adviser’s views on complex investments.

The regulation increased transparency around the benefits, risks and charges associated with investment products, requiring advisers to clearly demonstrate how an investment strategy meets customer’s needs.

Note figures may not add up to 100% due to rounding

Richard Whitehall, Head of Portfolio Management at Aegon UK shares advisers’ concerns. “A raft of absolute return and complex products launched following the 2008 financial crisis and have struggled to compete with more conventional multi-asset strategies in the long, bull market that followed. The volatility caused by the outbreak of Coronavirus appears to have been short-lived, and so didn’t help the case for complex solutions.

“The fact that advisers have turned their back on complex investments doesn’t come as a surprise in the current environment. While they’re aiming to do very different things, looking at the risk and return profile of absolute return strategies alongside simpler, multi-asset portfolios, what worries me is the dispersion of returns and risk in the sector. It’s my belief that today’s investors are a great deal more cost conscious and want to see value for money from their investments. At this point in time, it’s hard to see this coming from complex investments.”

Aegon UK’s 2021 Adviser attitudes report

|