3 key state pension facts:

1. Half (51%) of people expect to drop out of work before reaching the state pension age. Physical health, mental health and age discrimination are the main barriers preventing people from remaining in work.

2. Despite this, Phoenix Group’s new pensions heatmap finds over half of over 45 year olds in regions throughout the UK are worried they will need to keep working beyond state pension age to support their retirement income. This is highest among those in London and the North East (60% respectively). (NB: further stats are available from a regional pensions heatmap which is part of Phoenix Group’s campaign to encourage people to start talking about how we live, work, and save for our longer lives)

3. Half of people under the age of 50 think that there probably won’t be a state pension by the time they retire.

Phoenix Group’s Patrick Thomson, Head of Research and Policy at Phoenix Insights: “For 75 years the state pension has been a fundamental part of the intergenerational contract, paid for by the current workforce on the promise that it will support them when they reach their own retirement. But while its purpose has remained the same, how people work and retire, and the age structure of the country has changed dramatically since its inception in July 1948.

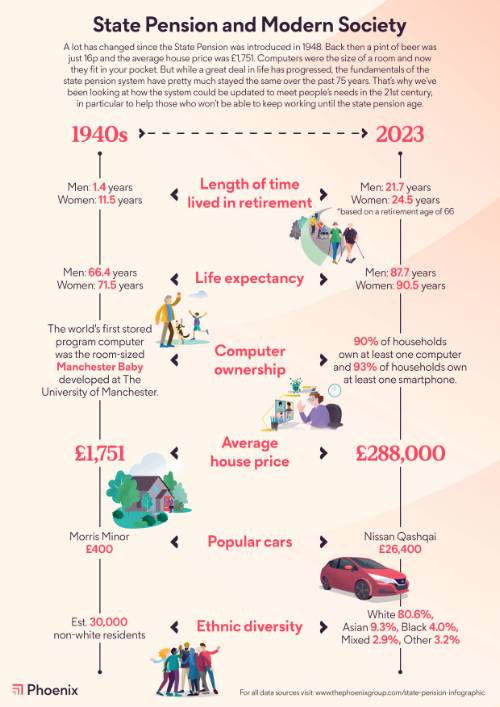

“In the late 1940s, men would typically spend just under 17 months in retirement, and women around 11.5 years. Today, reflecting long term increases to life expectancy, this is almost 22 years and 25 years for men and women respectively, even with increases to the state pension age.

“12.5 million currently claim the state pension and we spend over £110bn a year to fund it. With many people now living up to a third of their adult life in retirement, we need to make sure that we make the system both fair and sustainable for all generations.

Commitments to the triple lock appear to be baked into future manifestos ahead of the next general election, but decisions over potential increases to the state pension age are still very much on the table.

“Increases to the state pension age have been the preferred lever for policies makers to address the rising costs of our ageing society, and this lever could be pulled again through bringing forward the planned increase in the state pension age to 68.

Commenting on the future of the state pension:

”Simply telling people to work longer by raising the state pension age is a really blunt instrument, leaving behind many who are unable to work for health or caring reasons. Any changes to the state pension age must be coupled with further support for those least able to work, and action to make work better for more people as they age.

“We need to rethink how we work later in life, making it more accessible for those in their 50s and 60s and with better opportunities to upskill, change careers and save for a good retirement.

“Our research among people across the UK found the general level of understanding around how the state pension works requires improvement, trust in decision-making needs to be rebuilt and inequalities within the system should be addressed5. It is hugely concerning that half of people under the age of 50 think that there probably won’t be a state pension by the time they retire4. Future policy interventions should focus on ensuring the system is effective, trusted and fair.”

|