When the provisional figures were published in September, it was estimated that the growth in average earnings in the year to July was 8.5%. When the numbers are finalised this can sometimes result in a change to the figure. But today ONS have confirmed that 8.5% is the key number to be used in the triple lock calculation.

The other key figure is for inflation. The August CPI increase was 6.7%, but it is the September figure which is used for the annual uprating process and this is published tomorrow (Weds 18th). However, it is inconceivable that the inflation figure would have risen enough in a month for this to be the highest of the three elements in the triple lock. This means that if he is to stick to his manifesto pledge, the Chancellor will have to increase the new state pension and the basic state pension by 8.5%.

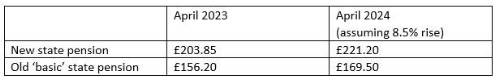

The table shows the current level of the new state pension and the old ‘basic’ state pension, and what it will be in April 2024 if the commitment to the triple lock is kept.

The new state pension will rise by £17.35 per week or £902.20 per year, whilst the old ‘basic’ state pension will rise by £13.30 per week or £691.60 per year. Other elements of the old state pension system (mainly ‘additional’ state pensions such as SERPS) will rise in line with the increase in CPI inflation, with the final figure due out tomorrow.

This increase comes on top of the 10.1% rise in April 2023 when the pension rise reflected the high level of inflation the previous year.

Commenting, Steve Webb, partner at LCP said: “Today’s figures confirm that the Government’s manifesto commitment to the ‘triple lock’ on state pensions means that they should rise by 8.5% in April 2024. Although this will cost the Treasury more than £8 billion, it is worth remembering that the UK still has one of the lowest state pensions in the Western World and there is some way to go before the value of the pension recovers from a thirty year period when it was linked only to price inflation. This increase will simply keep the rise in the state pension in line with the pay increases that many in work have enjoyed”.

|