Average withdrawal down 11 per cent on 2008

But increasing number are blowing the cash on holidays, cars and DIY

Almost eight in 10 (79 per cent) UK pensioners with private or company schemes are taking tax-free lump-sums out of their pension funds, averaging £21,500 at the point of retirement, according to new research from Prudential.*

The average tax-free lump-sum has fallen by 11 per cent since 2008 when pensioners were taking £24,154, suggesting that the effects of the recession have hit pension funds and pay-outs.

However, the Prudential study shows that an increasing number are spending the money on luxuries and DIY - or even giving it away - potentially reducing the monthly income they get from their pension fund dramatically as a result.

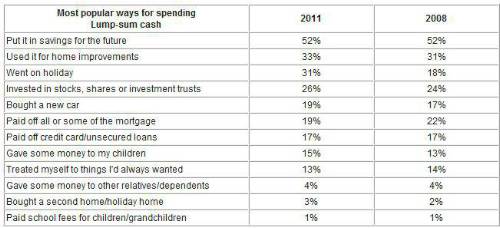

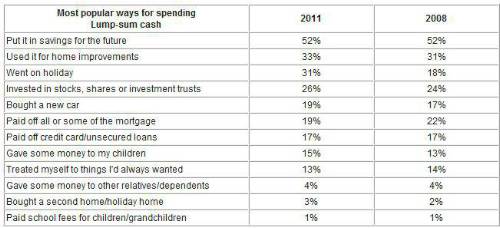

In addition, significant numbers are using the tax-free cash to clear debts - 19 per cent used part of the windfall to pay off some or all of their mortgage, while 17 per cent used the money to clear credit cards or loans.

More than half (52 per cent) of those who have taken a lump sum put at least some of this money in a savings account - a figure which hasn't changed since 2008. Making home improvements was the second most popular option, up 3 per cent from 2008 to 33 per cent. The most notable increase, however, was the number who chose to spend some or all of their lump-sum on a holiday - an increase of 13 per cent since the recession to 31 per cent. In addition, a fifth of pensioners (19 per cent) bought a car and a generous one in five (18 per cent) gave some or all of the cash away to family or relatives.

Vince Smith-Hughes of Prudential said: "The effects of the recession have made the majority of people in Britain more financially aware and cautious with their money. It's understandable that people are keen to enjoy the money they've worked so hard to earn when they retire - and pensioners are certainly doing that this year - but it is important to assess how this will impact on their long-term financial health before committing a significant part of their lump-sum. It should also be remembered that there are several methods which can be used to convert the lump-sum into an additional source of income.

"A high proportion of pensioners are choosing to spend their lump-sum on luxuries, despite the fact that the cost of living is rapidly increasing, so we're urging people to think carefully about how they are going to use this money and avoid making impulse purchases that may ultimately put them under financial strain. Consulting a financial adviser will help to determine the different options available."

Men appear to be more inclined to invest their lump-sum or pay off debts, with 31 per cent having chosen to buy shares, stocks or put money into an investment trust, compared with 20 per cent of women. Twice as many men (24 per cent) as women (12 per cent) used the money to take care of mortgage debts, and only 13 per cent of women used their cash sum to clear credit card and other unsecured loans, compared to 21 per cent of men.

|