The Climate Action Report – developed by sustainability research provider Profundo in partnership with green pensions campaign Make My Money Matter – assesses and ranks the climate strategies of the UK’s 20 largest DC workplace providers, who collectively manage more than £500 billion in assets, and have more than 15 million active members.

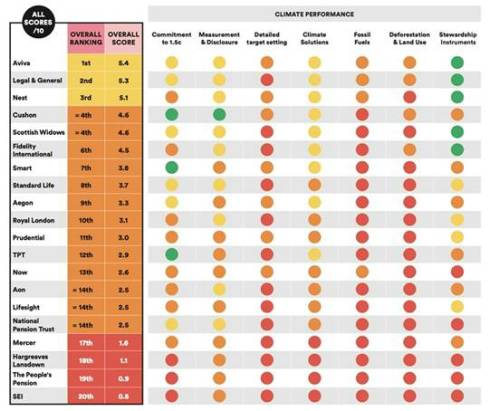

Despite almost all having publicly set net zero targets, the ranking shows significant failings in their detailed climate plans. Not one provider was deemed to be taking a leadership role on climate action. Just three of the twenty – Aviva, Legal & General and Nest – were found to have ‘adequate’ plans in place. 13 providers - including household names Royal London, Prudential and Standard Life - have plans deemed inadequate. The four worst performing providers – Mercer, Hargreaves Lansdown, The People’s Pension and SEI – who manage the pensions of over 2 million UK savers, have ‘poor’ plans in place, scoring on average just 1 out of 10 for climate action.

Richard Curtis, co-founder of Make My Money Matter, commented on the ranking: "Climate leadership is not just important for the planet – it's popular too. But the fact that 17 of the UK’s top 20 providers have inadequate or poor climate plans tells you all you need to know about how seriously the industry is taking this issue.

The public will rightly be worried about these results, and we hope this ranking acts as an urgent wake up call for the pensions industry to up its game on climate change. In doing so they can help protect the planet and provide savers with pensions they can be proud of.”

Approach

The first of its kind analysis from Profundo reviewed the 20 providers’ publicly available climate documentation, assessing the extent to which each has effective objectives, policies, and instruments in place to respond to climate change and drive real world impact.

Detailed analysis was undertaken on seven core indicators of climate action: a commitment to a 1.5-degree pathway, measurement and disclosure of carbon footprint, detailed target setting, investments in climate solutions, a phase out of fossil fuels, deforestation and land use, and portfolio stewardship instruments. Providers were scored against criteria for each – using internationally recognised standards - with results totalled and ranked. See Editors Notes for full details on the methodology.

Results

Across the board, results are worrying, and run counter to public claims of climate leadership. While this ranking shows most have set broad climate targets, the majority are failing in the substance, detail, and implementation of these plans. On two critical areas of climate action, progress is woefully inadequate:

- On policies related to coal, oil and gas, 8 out of the 20 scored 0/10

- On deforestation and land use, all 20 were found to have poor or inadequate plans

On average, providers scored just 3.2 / 10. This shows that despite pockets of progress, the majority are failing to implement ambitious, science-based climate plans. Further inadequate action risks alienating pension holders who expect leadership from their provider and threatens long term financial returns as schemes fail to sufficiently address climate risk.

While this does not constitute financial advice, Make My Money Matter hopes this ranking helps savers and employers make more informed and environmentally conscious decisions on their pensions and encourages the UK’s largest providers to ramp up climate action in 2024. Specifically, Make My Matter is calling on all providers to end finance for fossil fuel expansion, tackle deforestation in their portfolios, and urgently scale up investments in climate solutions. For more information, see www.makemymoneymatter.co.uk/pensions

Tony Burdon, CEO of Make My Money Matter, commented: “In a year where an average temperature rise of 1.5 c was exceeded for the first time, this report should concern everyone who cares about their pensions, or the planet.

While there are pockets of progress which indicate what funds could achieve if they showed energy and ambition, overall leadership is scarce and progress slow. That’s why we now need all pension providers to recognise the findings of this report and invest in the skills and capacity needed to meet the climate crisis.”

Jan Willem van Gelder, Director of Profundo, commented “Given the disappointing results, I encourage UK pension providers to use the methodology of this study as a guide on what the public can expect of a robust climate action plan. Grand commitments to tackle climate change need to be followed by bold actions.”

|