Key findings of Hymans Robertson’s survey of Independent Trustees* include:

-

Only 1 in 10 believe that fiduciary managers are best placed to deliver investment advice aligned to the interest of the scheme

-

Independent Trustees also think it’s more expensive: 59% believe that fiduciary management services costs more than independent advice;

-

Almost a third think it costs 50% more, a quarter 1-2 times more and 6% believe it costs 2-3 times as much as independent advice;

-

A mere 4% of independent trustees said 15 or more managers would be optimal for their scheme. This is in the context of fiduciary structures having upwards of 40 managers;

-

The most popular number of manager appointments per scheme was 3-5, favoured by almost half of those surveyed;

-

59% expect a series of specialist managers working alone will deliver better investment returns, after costs, compared to a multi-asset mandate delivered by a single manger.

Hymans Robertson’s survey of Independent Trustees, an in-depth survey of leaders in the ‘professional’ trustee community, with responsibility for over 100 UK Defined Benefit (DB) schemes, found that nine in ten believe independent consultants are best placed to deliver investment advice aligned to the interests of the scheme. Only one in ten backed fiduciary managers and just 4% said asset managers were best placed.

Commenting, Calum Cooper, Partner at Hymans Robertson, said: “Trustees have more issues to deal with than ever before. They are time poor and often feel they lack the ability to move quickly. In that context it shouldn’t be a great surprise that schemes are drawn towards ways that reduce the workload. On the face of it, delegated consultancy or fiduciary management do that. But it comes with a hefty price tag – as evidenced by this research – as well as conflicts.

“On the surface, delegation may appear to reduce trustees’ workload but it also means an extra layer of scrutiny is required to monitor the fiduciary manager. To put it another way, delegating doesn’t remove work and risk; it simply changes its nature. Those with fiduciary managers in place often appoint other investment consultants to oversee their activities.

Discussing the FCA’s announcing it would review the activities of consultancies offering fiduciary services, he added: “The FCA’s decision to consider the conflicts of interest implicit in investment consultants helping trustees pick asset managers, while offering competing services of their own, will be welcomed by many. In our view trustees should retain control of key decisions that affect their schemes and impact on members. It was for this reason, and the conflicts inherent in the model, that we consciously didn’t go down the fiduciary or delegated consulting route with our business. Back in the 1990s we saw SEI sell its consulting business in the US when it established a fund management offering for the same reason.

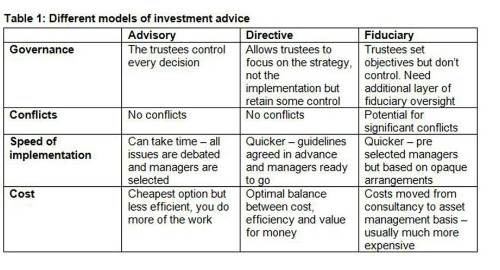

“The key for us is that fiduciary responsibility remains with the trustees. We strongly believe trustees should continue to remain engaged with key decisions. To put it another way, it’s important to have intellectual skin in the game. That means retaining control through appropriate governance arrangements and delegating in the most efficient way (see table 1 for an overview of governance structures). We think a directive consulting approach gives trustees breathing room to focus on high level strategy while advisers get off the fence and make clear strategic recommendations through to taking care of implementation. This allows for quick decision making but without the conflicts and higher costs.”

Commenting on Independent Trustees’ views of multi-manager funds, he added: “Firms acting as fiduciary managers tend to offer investment funds. In many cases arrangements between schemes and managers can be opaque and difficult to define.

Delegating asset management is what most schemes do, and multi-manager funds have been around for a long time. Many fiduciary offerings are just that – multi-manager funds in specific asset classes. It’s telling that 59% of independent trustees told us that they’d expect a series of specialist investment managers working alone to deliver better investment returns, after costs, compared to a multi-asset mandate delivered by a single manger.”

Discussing the role of independent trustees on DB schemes, he concluded: “While non-professional trustees still fill the vast majority of seats on pension fund boards, the number of independent trustees has seen rapid growth. It is these professional trustees who are at the vanguard of trusteeship and who hold the key to understanding the aims, expertise and characteristics of UK DB funds. Often chairing multiple trustee boards, independent trustees have a unique overview of the pension fund universe and have the technical knowledge to cut quickly to the core issues. The growth of independent trusteeship undoubtedly has professionalised decision making.”

|