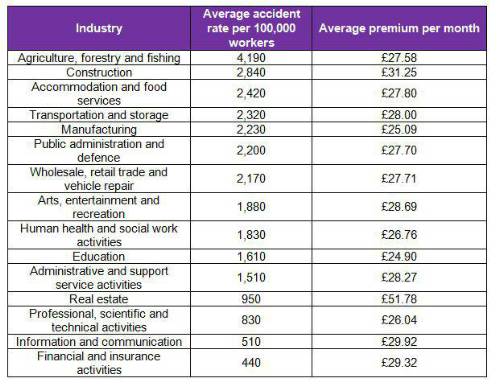

The agriculture, forestry and fishing had the eleventh highest average life insurance premium (£27.58 per month2) out of the 15 industries analysed3, despite there being 123% more accidents per 100,000 workers4 than the average. What’s more, real estate professions had by far the most expensive monthly premiums (£51.782), 88% higher than those working in agriculture, forestry and fishing, despite an average accident rate that is 77% lower4.

While the impact on premiums of working in a dangerous industry is negligible, smokers across all occupations pay an average of 54% more for all types of life insurance – including, for instance, decreasing-term and renewable term – than non-smokers2. This suggests that other factors may be playing a much more significant role than risk in determining life insurance costs.

Looking at the average monthly life insurance costs for the occupation with the most enquiries within each industry, dangerous jobs with monthly premiums below the average of £29.39 include HGV drivers (£28), prison officers (£27.70) and carpenters (£25.09)5.

Additional MoneySuperMarket data shows that farmers and builders are paying £18,277 and £17,559 respectively on life insurance over the course of a lifetime6, lower than perceived ‘safer’ jobs such as TV and theatre producers and IT consultants (£24,149 and £19,066 respectively), despite farmers and builders seeing the highest number of fatalities since 2017 (29 and 38 respectively).

When comparing the average premiums of smokers and non-smokers working in the same industry, smokers pay on average £13.82 more a month for their life insurance policy.

By splitting each industry into smokers and non-smokers in order to assess their respective premiums, it shows that 15 of the 16 most costly are for people who smoke. In fact, a smoker in a relatively ‘safe’ industry such as finance and insurance will still be paying significantly more each month (£40.84) than a non-smoker in a more dangerous industry such as construction (£25.35).

Rachel Wait, consumer affairs spokesperson at MoneySuperMarket, commented: “Those who are acutely aware that their job is more dangerous on a daily basis than average can feel reassured that having a riskier role doesn’t necessarily mean you’ll pay more for your life insurance.

“Of course, each quote is entirely unique, with a variety of factors coming into play. It’s best to double-check that the details you provide are accurate to ensure a suitable quote and avoid higher premiums”

Visit MoneySuperMarket, for more information on average life insurance premiums within different industries.

|