By Alex White, Head of ALM Research at Redington

If all your assets always move up or down together, then by definition they’re not diversified. So if they all go up, even in one year, that is some (partial) evidence that they’re not diversified- it should at least lower your prior assumption about the level of diversification there is, even if only by a little.

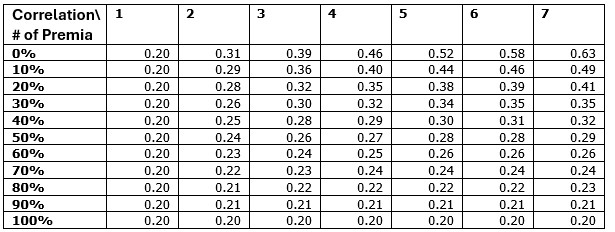

To quantify this, we looked at portfolios of 1-7 risk premia. For simplicity, all premia are lognormal with a 2% log return, 10% log volatility, all correlations are the same, and all portfolios are equally weighted. The chart below shows the simulated Sharpe ratio for different correlations and different numbers of assets- for example, with 3 assets, all 20% correlated to each other, the Sharpe is 0.32. Diversification makes a very material difference to risk-adjusted returns.

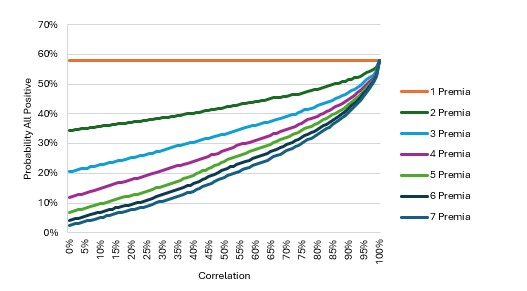

We then look at how likely it is to have every asset show a positive return in a given year:

This chart is broadly the reverse of the table above- with more assets and lower correlations, the probabilities plummet. Now, investments are complicated, and things change, so we want to adapt our assumptions as new evidence emerges. In general, we don’t know with perfect certainty how various assets and risks interact, so we should update our assumptions accordingly- that is, we should be Bayesian.

To make this more concrete, we need a prior. For simplicity, we adopt an extremely simple and extremely agnostic prior- we assume the underlying correlation is between 0 and 1 with a uniform distribution- i.e. we have basically no information at all (negative correlations are possible, but not “at scale”, in that lots of assets can’t all be strongly negatively correlated with each other). With 2 risk premia, our central estimate for the correlation becomes 55%- 2 uncorrelated risk premia going up together is still quite likely, so the estimate doesn’t move much; but with 7 premia, if all we know is they all moved up last year, our central estimate for the correlation between them would be 73%. We’d have 95% confidence they were more than 20% correlated, and the interquartile estimate for the correlation would be roughly 50-90%.

This involves a number of huge simplifications, so the numbers themselves should be taken with a vast grain of salt. But the principle holds- if you have a diversified portfolio, with several risk factors with genuinely low correlations between them, it’s very likely at any point that, purely by chance, one of them will struggle. If they move together, either there aren’t many premia or they’re likely to be correlated; either way, if all your assets go up at the same time, your portfolio is probably not diversified.

|