-

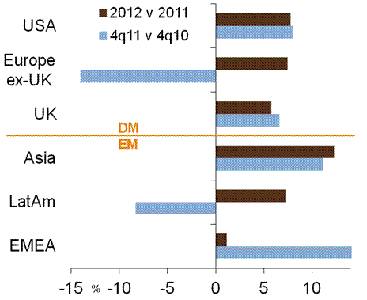

Earnings growth in developed markets projected to improve from 3% at the end of 2011 to 8% by the end of 2012

-

Emerging market EPS change should remain stable at 7-8%, but better chance that actual results will be stronger

-

Even with rally in prices over the last several months, there is still potential for meaningful equity market gains this year

|

Market Changes over the past week

|

|

|

|

|

(Through Friday, 10 Feb 12)

|

|

|

|

|

Region

|

Equities (%)

|

Bonds (bps)

|

Currency* (%)

|

|

Eurozone

|

-1.3

|

-1

|

0.8

|

|

UK

|

-0.8

|

-7

|

-0.4

|

|

US

|

-0.2

|

6

|

0.4

|

|

Japan

|

2.6

|

3

|

-1.3

|

|

EM

|

-0.2

|

1

|

-0.2

|

|

*Broad, effective indices

|

|

|

|

Can earnings growth support further gains in equity prices?

Though investors will undoubtedly be focused on the negotiations over Greece's second bailout this week, it may be worthwhile to step back and consider the broader outlook for equity markets for the year. Since last October prices have risen over 17% (MSCI ACWI), reducing the discount the market had been trading at by 10% (the current forward multiple is still 28% below its average since 1987). If risk aversion continues to fall as the situation in Europe stabilises, equity prices should be driven less by swings in sentiment and more by the outlook for company profits.

There is wide dispersion even at the regional level in earnings growth rates, with different sectors affecting the returns of each market in its own way (see chart). For the fourth quarter of last year, analysts expect developed markets (DM) to produce net income gains of just 3% over the same quarter in 2010. This compares to projections of 7% for emerging markets (EM), with emerging Asia and EMEA even better (Petrobras explains much of the negative change in LatAm. If the company is excluded, the growth rate is 2%). Despite the better earnings growth in emerging markets relative to developed markets in 2011, EM equities nonetheless underperformed DM equities for the year. This is one reason we expect EM equities to do better in 2012: with widespread risk aversion no longer depressing returns, better earnings growth should be reflected in relative price appreciation.

Earnings growth (year-on-year)

Note: MSCI standard indices. Source: Bloomberg, Thomson Reuters, J.P. Morgan Asset Management.

More important for future returns are the expected gains in company profits. The growth rate in the USA dropped from 19% in 3q11 to 8% in the fourth quarter but it should maintain that pace throughout the year. Though the economic landscape is only modestly positive, we believe that US corporations are continuing to find ways to improve productivity and increase earnings per share. Business investment should be maintained thanks to low interest rates and large cash balances, but share buybacks may become a key means to boost EPS. Analysts forecast European corporations to increase profits by 7% this year, though for eurozone companies this may reflect more a rebound from the very negative results in 2011. Emerging market growth is projected to be just slightly better than developed markets, 8% compared to 7%, but this figure is depressed by the drop in earnings for Russia's energy sector (as always, it's crucial in emerging markets to know which companies and sectors offer the best opportunities). Every country in emerging Asia is expected to increase their profits by at least 10% while there is more variation between countries in the other regions.

In the long run, equity price appreciation is driven by earnings growth. With EPS gains of around 8%, a dividend yield of nearly 3%, and the potential for better valuations, we believe that equity markets may yet return another 10% this year even after the rebound we have already seen.

|