Perceptions of retirement

A ‘hard stop’ or ‘transitional’ retirement is seen as the most prominent way people have moved into retirement over the last 50 years but is expected to dwindle significantly in the future. Only 15% of UK adults think it will represent most people’s experience in the next 10-25 years.

The biggest change between retirement perceptions in the past and the future is a large, anticipated increase in people never really retiring because they want or need to keep working. 41% of UK adults expect this to be the norm in the next 10-25 years, up from 13% in the past.

Retirement as a period of transition, where people reduce the amount of time they spend working and balance it with doing other things, is expected to continue to be the most common experience.

Hopes vs expectations

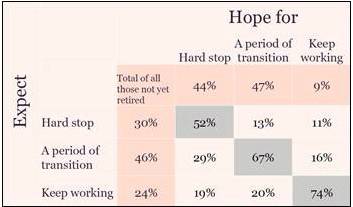

The research looked at hopes compared to expectations of moving to retirement. 44% hope for a ‘hard stop’, 47% hope for a period of transition, and just 9% hope to keep working. However, when looking at expectations, 30% expect a ‘hard stop’, 46% expect a period of transition, and 24% expect to keep working.

Just half (52%) of those who have still to retire who are hoping for a hard stop realistically expect to achieve this, and one in five (19%) of this group think they will actually have to keep working.

Phoenix Insights research among UK adults, hopes vs expectations for retirement.

Phoenix Group’s Catherine Sermon, Head of Public Engagement and Campaigns (Phoenix Insights) comments: “The idea of a ‘hard stop’ retirement has long been superseded by people looking to reduce their working hours and gradually transitioning into retirement, many working part-time while drawing on some of their pension to supplement income. Moving forward, however, while a gradual transition into retirement is expected to remain popular, our research suggests a sea change is looming, with a significant rise in people anticipating they will carry on working throughout their life.

“It’s vital that this changing approach to retirement is matched by how people are supported in work and saving throughout their life. There will need to be more flexibility so people who want or need to remain in work for longer are able to do so. This should go hand-in-hand with policy change to help people save more. Millions of adults are off track and not saving enough to provide the retirement income they expect and may end up delaying their retirement plans as a result. Increasing the minimum auto enrolment contribution rate being made into workplace pension should be a high priority in the next Parliament to help close some of pension savings gap.”

|