• Swiss Re forecasts moderate strengthening in global economic growth in 2016 and 2017, supporting insurance growth

• Non-life premium growth set to improve in 2016/17, led by an 8% to 9% growth in emerging markets

• Reinsurance catastrophe property rate softening expected to moderate in 2016

• Life insurers will remain resilient in the face of major challenges; premium growth and profits should continue to improve

• Growth for traditional life reinsurance premiums are expected to be healthy in the emerging markets but subdued in the advanced markets

The global economy is expected to strengthen moderately next year. The US and the UK economies are currently growing by close to 2.5%, and real gross domestic product (GDP) growth in Japan and the Euro area are a more subdued 0.7% and 1.5%, respectively. The four economies are all expected to see slightly better growth in 2016. Emerging markets will grow by about 5% in each of the next two years, an improvement on the current 4% pace.

The global economy faces three main headwinds: slower growth in China, lower commodity prices and an imminent rate increase by the Federal Reserve. The headwinds pose a risk to the baseline forecast, but are unlikely to derail the improving growth momentum. With the overall improved outlook and expected monetary policy tightening in the US and UK, government bond yields (especially in the US and the UK) will likely rise.

"Global economic growth is a good sign for insurers," says Kurt Karl, Swiss Re's Chief Economist. "This is especially so in the emerging markets, where urbanisation and growing wealth will support overall sector growth. We've said for some years now that emerging markets are the growth engines for the insurance industry – and this is expected to continue for at least several years more."

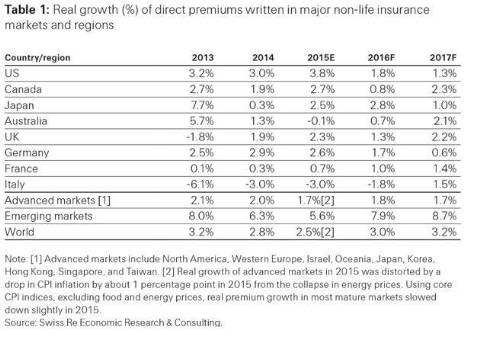

Non-life premium growth will improve along with economic activity

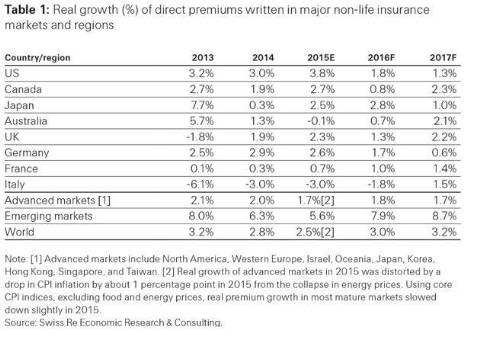

Demand for primary non-life insurance should increase in the next two years. Global primary non-life premium growth is forecast to improve to 3% in 2016 and 3.2% in 2017, from 2.5% this year. Growth in advanced markets is expected to slow slightly due to the generally softening prices and only modest improvement in economic growth. The emerging markets will be the main drivers in non-life, with premiums up an estimated 7.9% and 8.7% in 2016 and 2017, respectively, after a 5.6% gain in 2015. Premium growth is expected to be strongest in emerging Asia (12% annually), and a recovery is expected in Central and Eastern Europe after contraction in 2014 and 2015.

Despite the challenging pricing environment, underwriting profits in primary non-life insurance have been sustained by low natural catastrophe losses and a continuation of reserve releases from past years. The non-life reinsurance sector underwriting result has likewise been strong so far this year, also based on low natural catastrophe losses. However, with falling prices, profit margins have eroded over the past two years. Property catastrophe reinsurance rates are currently close to bottoming out and the rate softening in most lines is expected to moderate or come to a standstill. In casualty and specialty, significant differences in pricing developments by market and line of business are expected.

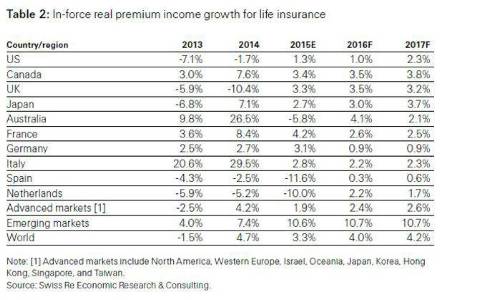

Table 1

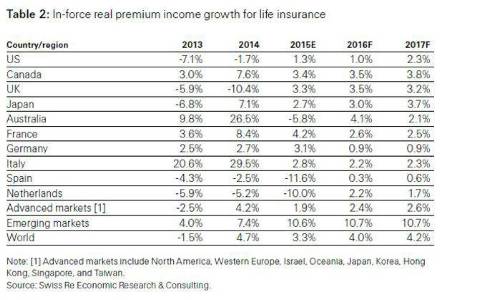

Life insurers face major challenges but premiums will grow

Primary life insurers face significant downside risks in the short to medium term from the modest global growth outlook, persistently low interest rates, volatility in financial markets and regulatory changes. Nevertheless, in the advanced markets, real premium income is forecast to rise by about 2.5% in 2016 and 2017, up from about 2% this year. In emerging markets, premiums will grow by an estimated 10.7% in both 2016 and 2017. This improvement will in part be attributable to improved use of currently available technologies, such as wearable devices and cloud computing. Again, emerging Asia is expected to have the most robust growth of about 13% each year. A key issue in many emerging markets will be the implementation of risk-based solvency regimes.

In the advanced markets, life reinsurance premium growth is expected to decline slightly in 2016 and 2017 in real terms. In the US, regulatory changes – including increased scrutiny of the use of captive reinsurance and an expected move towards principles-based reserving – will impact business opportunities. In other markets, traditional life reinsurance will continue to record low, single-digit growth in line with the protection business on the primary side. Growth in emerging market life reinsurance premiums is expected to be about 7% to 8% each year in 2016 and 2017.

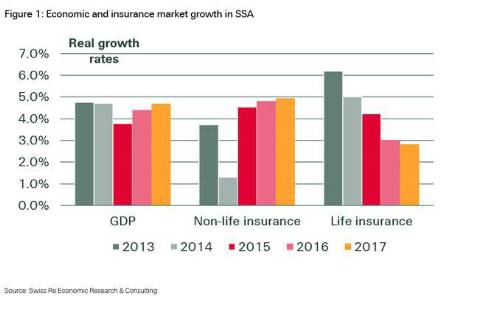

Economic headwinds in Sub-Saharan Africa

This year's outlook report covers Sub-Saharan Africa (SSA), which faces headwinds as commodity prices remain low and capital flows out of the emerging markets. GDP growth in SSA is forecast to slow to around 3.8% in 2015 from 4.7% in 2014, but the region is still the fastest growing after emerging Asia. Non-life premium growth increased to 4.5% in 2015 so far, after having been suppressed in previous years by the increased enforcement of the cash-and-carry principle. With this principle, insurers can only issue policies and book premiums after they have received payment. Premiums in South Africa recovered in 2015, despite a weak economy and intense competition, as insurers raised rates on the basis of past claims experience.

Demand for non-life insurance is likely to remain solid in SSA in 2016 and 2017, with premium growth of 4.5% to 5.0%, even though volumes are expected to stagnate or even contract in some of the oil- and commodity-exporting countries. Global and regional insurance groups continue to expand their footprint in SSA which will enhance expertise in the region.

Life premium growth in the region is estimated to have slowed to 4.2% this year from 5% in 2014, and will likely slow further to about 2.5% growth in 2016 and 2017. Growth weakened to 3.8% in South Africa in 2015 as the economic environment failed to improve and the rand was hit by capital outflows. Elsewhere in SSA (eg in Kenya and Nigeria), growth is estimated to have remained strong. However, given that South Africa accounts for around 90% of the region's premiums, the results for SSA overall were disappointing.

|

Table 1

Table 1