A significant number of Gen Z (people born in or later than 1996) believe property will be their main source of wealth in retirement, according to new research1 from Standard Life’s Retirement Voice report, which reveals different attitudes between generations when it comes to funding life after work.

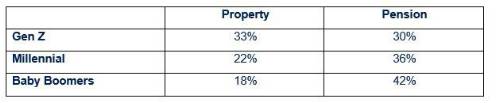

A third (33%) of Gen Z intend to use property to fund their retirement – slightly ahead of those who plan to use pensions (30%). This is in contrast to older generations, with Baby Boomers (people born between 1946 and 1964) favouring a reliance on pensions (42%) rather than property (18%), while more Millennials (those born between 1981 and 1996) also see their pensions as their main asset in retirement (36%) rather than property (22%).

Percentage favouring property or pension to fund retirement

Furthermore, when it comes to how different generations view their home in financial terms, 35% of Gen Z see it as a source of wealth that they can draw on if needed, particularly during retirement, compared to only 24% of millennials and Gen X, and 20% of Baby Boomers.

Unrealistic expectations?

While many young adults intend to use their property as their main source of retirement income, Standard Life’s research, conducted among more than 6,000 people, highlights that this may not be a realistic expectation, especially given the nature of the housing and mortgage market today. Just one in ten (10%) of Gen Z currently have a mortgage that they could have started paying off, while 20% are worried about the prospect of having to pay off a mortgage in retirement. Longer lives think tank Phoenix Insights estimates that, based on current expectations, over 13 million people are likely to face ongoing rental or mortgage costs in retirement. 2

Commenting on the property vs pension question, Gail Izat, Managing Director for Workplace at Standard Life: “It’s understandable that younger people expect property rather than pensions to fund their retirement as buying property is likely to be their biggest current financial goal, and pensions less of a priority. However, in many ways it’s far harder for Gen Z to rely on property alone than previous generations – they’re facing higher house prices compared to their salaries, higher mortgage costs as well rising rental costs preventing many of them from saving enough to buy. This underlines the importance of employers and providers engaging with people of all generations, and making sure products, services and communications are relevant to each audience. Open finance tools can help people view their finances in the round – and could show how owning property and saving into a pension aren’t mutually exclusive, and can instead sit together as part of a diverse portfolio.

“Pensions have a number of advantages such as tax relief on contributions, employer contributions and the potential to benefit from investment growth. On the downside, pension savings can’t be accessed until the minimum pension age, and people with a Defined Contribution pension will need to assess how long it needs to last when considering how much to save and how much to take each month in retirement, unless they take an annuity.

“With property, there’s the option to sell before the minimum pension age but for most people, their property will be their home – so to access any money they’ll have to downsize, move to a cheaper area or consider equity release. Equity release can be valuable for people without any other assets but its important anyone considering this takes advice to make sure it’s right for them.”

|